Executive Summary

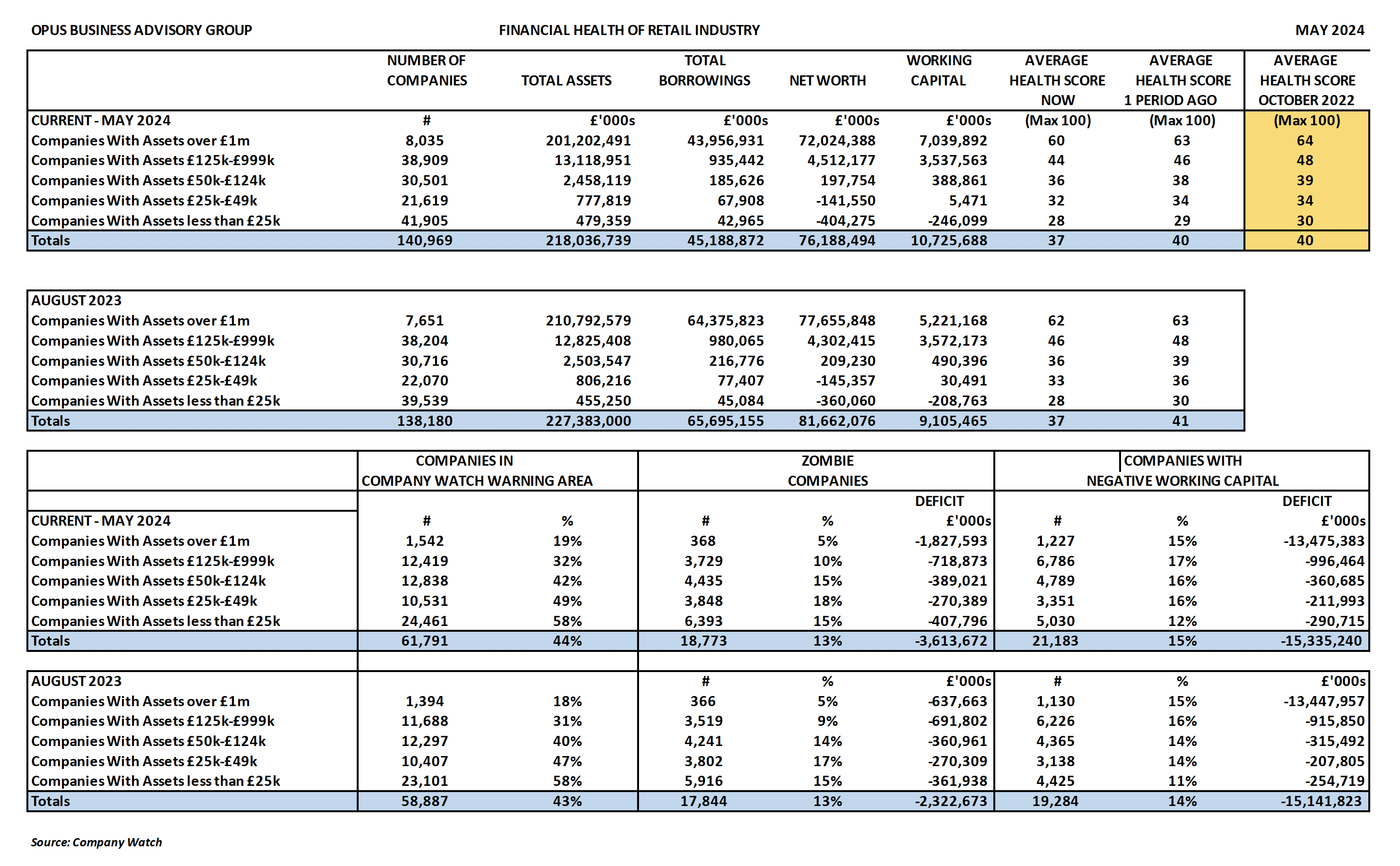

- The overall financial health rating of retailers has fallen from 40 (out of a maximum of 100) to 37 since October 2022.

- The decline in financial health is most pronounced among larger retailers.

- The number of financially vulnerable retailers at risk of failure has escalated from 39% in October 2022, to 43% in August 2023 and to 44% now.

- The sector is disinvesting, with total assets falling by 8% from £237bn in October 2022 to £218bn now and net worth dropping 9% from £88bn in October 2022 to £76bn now.

- Borrowings have fallen even more dramatically by 31% from £66bn in October 2022 to £45bn now.

- The fall in debt is concentrated mainly in the largest retailers.

Introduction

After initial fears that the cost of living crisis and its impact on consumers’ spending power might make the vital festive season in 2023/24 especially difficult for retailers, the initial mood music from the sector was that trading had not been as badly affected as the worst case expectations. This coverage was based on the sector’s and the media’s long-time obsession with top-line revenue and the constantly quoted ‘like-for-like’ sales outcomes.

Now that the reality of bottom-line profit figures has been published, a much more nuanced picture has emerged with some clear winners and some significant losers in the retail sector. Among the highlights were:

- Major trouble for online, pure play operators, with Boohoo and ASOS reporting annual losses of £160m and £120m respectively.

- Blame being laid at the door of the government’s stubborn refusal to abolish the so called ‘tourist tax’ by restoring VAT-free shopping for international tourists. Selfridges and Mulberry were among the luxury retailers citing this factor.

- Substantial job cuts at some challenged retailers, such as John Lewis, Monsoon/Accessorize and Carpetright.

- Perennial good news from Next, reporting that their Q1 2024 sales had exceeded expectations.

- Major inventory problems for some fashion retailers, most notably the revelation that Superdry has been struggling to clear an overstock position of 19m garments over the past five years.

Market Issues

We last reported on the retail sector in September 2023 in the nervous run up to the last festive season. In that report, we listed a number of key challenges faced by retailers. Many of these challenges are still impacting performance this year, and two significant new challenges have emerged.

Historic issues:

- Although labour market issues show signs of easing, they continue to cause recruitment and retention issues, as well as driving up staffing costs. One major supermarket chain has just raised pay rates for the third time in twelve months to stay competitive.

- Despite a significant fall in inflation and pay rises running ahead of inflation, consumer spending remains constrained, not least by big increases in mortgage and rent costs.

- Cash flow pressure from repaying additional borrowings taken on during the pandemic. The significant fall in borrowings (£21bn in just over eighteen months) shows just how much financial resource has been paid away from the sector.

- Sharply higher interest rates on variable rate borrowings.

- Government apathy and inertia have allowed yet another increase in the iniquitous and regressive business rate burden to kick in, with retailers’ costs being pushed up by £400m a year from the beginning of April.

New challenges:

- Increases in the National Minimum Wage have long been a major factor for retailers, but a 10% increase this April was an altogether different order of magnitude to any other rise in recent years. This is a double-edged sword in that it also raises spending power, but it is surely a worrying extra net downside for many struggling retail businesses.

- Artificial Intelligence is taking the commercial world by storm, with changes that used to be measured in years now happening in weeks. Retailers, like every other business, are pondering how to react to AI and how it will change their operations, especially interactions with their customers. Ignoring it is not an option for most, but weighing the high up-front investment costs against uncertain future benefits is causing a lot of executive head scratching.

Retail performance trends are difficult to track, principally because the ongoing indices (such as the retail sales trend data published by the Office for National Statistics and separately by the British Retail Consortium) fail to reflect fully or meaningfully what is happening across the sector. In addition, they suffer from being focussed on the retail sector’s obsession with top-line sales, as opposed to bottom-line profitability.

Interpreting the data has been made more difficult this year by some unusually adverse weather and by an inter-month change in the timing of Easter. This is well illustrated by the latest comments from the BRC that April sales were down by 4% on last year, but the figures for March and April combined were actually up by 0.2% with the Easter effect eliminated. Likewise, footfall in April was 7.2% down but was also affected by Easter.

Market Characteristics

Retail Economics have identified the following key data points for 2023:

- Total value of UK retail sales were £462bn (2022: £441bn)

- People employed in UK retail were 2.9m (2022: 3.0m)

- Proportion of consumer spending that goes through retail is 1/3 (same as for 2022)

- Percentage of retail sales made online was 26.6% (2022: 27%)

- Growth in UK retail sales value was 5.2% (2022: 4.7%)

- Total number of VAT-registered retailers in the UK were 217,000 (2022: 224,250)

- Total number of retail outlets in the UK was 306,340 (2022: 317,005)

- Retail generates 6% of total GDP (2022: 5%)

- Online retail sales rose by 5.1% in 2023, compared to growth between 2019 and 2022 of 73%

Our latest research using analytics provided by financial health monitoring specialists, Company Watch, shows the following overall financial characteristics:

- Total Assets Employed – £218bn (pre-pandemic £240bn)

- Total Debt – £45bn (pre-pandemic £70bn)

- Total Net Worth – £76bn (pre-pandemic £84bn)

Financial Risk

We have used the Company Watch financial health monitoring system to research the latest financial statements filed at Companies House by every company registered in the UK, which operates in the retail sector. Our research covered a total of 140,969 companies.

The stand out feature of this latest profile compared to the pictures in August 2023 and October 2022 is that the average financial health rating (H-Score® – see below) of the whole sector has dropped significantly since eighteen months ago from 40 to 37 now out of a maximum of 100. The average H-Score for the economy as a whole is around 48.

What is even more striking is that this deterioration can be seen right across the size spectrum, from the largest chain retailers to the smallest independent:

- Retailers with total assets over £1m – average H-Score is down from 64 to 60

- Assets £125k to £1m – down from 48 to 44

- Assets £50k to £124k – down from 39 to 36

- Assets £25k to £49k – down from 34 to 32

- Assets less than £25k – down from 30 to 28

Insolvency Risk

Company Watch uses complex analytics to generate an H-Score for every company out of a maximum of 100. This score is based on the company’s latest published accounts and a number of key measures within those accounts. An H-Score of 25 or less indicates that the company concerned has a one-in-four risk of going through a formal insolvency process or a significant financial restructuring at some point during the next three years.

Out of our sample of 140,969 companies, 61,791 or 44% (October 2022: 39%) are in the Company Watch Warning Area with H-Scores of 25 or less. Once again, we broke our results down according to the size of each company. For businesses with:

- Total assets between £50k and £124k, 42% were in the warning area (36% in October 2022).

- Total assets between £25k and £49k, 49% were in the warning area (44% in October 2022)

- Total assets below £25k, 58% are at serious financial risk (56% in October 2022).

Even with major retailers there is a higher percentage at risk – 19% now vs. 16% in October 2022.

Across the whole economy, some 19% of all companies are in the Warning Area.

This confirms that while there are some much larger retailers with serious financial issues, the vast bulk of financial risk in the sector lies with the smaller, less well capitalised businesses.

Zombie Companies

We also identified any ‘zombie’ companies with negative balance sheets (by at least a de minimis figure of £20k). 18,773 (13%) retailers were zombies with a combined excess of liabilities over their assets of £3.6bn. It remains worrying that one in eight retailers has filed a balance sheet that is technically insolvent.

Negative Working Capital

We also looked at companies with negative working capital, where their liabilities falling due within a year were greater than their current ‘quick’ assets such as cash, inventory and receivables (again by at least £20k). We found there were 21,183 (15%) such companies. This too is a negative indicator for the financial health of the sector.

Debt

After debt levels had stabilised in August 2023, there has been a major reduction in borrowings in our latest research. Total debt has fallen by an unexpectedly high level of 31% in less than a year, from £65.7bn in August 2023 to only £45.2bn now. Looking at the sector according to size of company, this reduction is heavily focussed among the largest retailers with assets of £1m of more, which have cut their borrowings by over £20bn.

A more detailed summary of our research can be found below.

Retail Insolvencies

Last year was a record year for corporate insolvencies, with the total of 26,595 beating the previous high in 2009 at the height of the global financial crisis. 2024 had started on a continuing rising trend until a reduction in March.

Retail failures continue to run at 9% of all insolvencies, with 2,226 retail companies in England & Wales filing for insolvency in the twelve months to February 2024. This compares to only 1,307 (7.6%) retail insolvencies in 2019 before the pandemic. It’s notable that the current failure rate is higher than the sector’s 6% share of GDP, confirming the higher risk factors for retailers.

Major Retail Failures

The Centre for Retail Research maintains statistics covering the failure of major retailers in the UK. These figures capture the number of companies affected, as well as the number of retail stores and retail jobs put at risk.

The outcome for 2023 was a record since the start of the collection of this data, at least in terms of the number of businesses affected (61), but nowhere near some other years looking at the number of stores affected (971) and jobs at risk (20,642). The clear conclusion is that it was the smaller major retailers getting into financial difficulty last year, compared to 2020 (which was mainly down to Covid disruption) or 2008 (which was heavily distorted by the Woolworths mega collapse).

2024 has not started well, with three major failures already with Ted Baker, Body Shop and FarFetch all going into Administration. After four months, there may have only been a fifth of last year’s number of failures, but already the jobs at risk tally has hit half of the figure for the whole of 2023.

These statistics do not include companies undergoing a Company Voluntary Arrangement (CVA) unless they subsequently go into Administration or Liquidation.

Retail Profit Warnings

The consultants, EY Parthenon publish quarterly reports on profit warnings issued by listed companies. Listed retailers issued seven profit warnings in Q1 2024, two more than in the same quarter in 2023. Over the past twelve months, retail ranks second as the sector issuing the most profit warnings, posting 25 warnings.

The fact that such sophisticated companies face sufficient business disruption and uncertainty that they were unable accurately to predict their profitability, should cause serious concern, not least for smaller, less-well capitalised retail, who face the same problems but with far less capacity and resource to cope. With continuing cost of living and disposable income pressures on consumers and input cost inflation from such factors as the hikes in business rates and the minimum wage, retailers are particularly vulnerable.

High Street Vacancy Rates

The latest data on high street vacancies released by the Local Data Company is for H1 2023. It indicates a static position with a rate of 13.9%, very marginally up from 13.8% at the end of 2022 but down equally slightly from H1 2022, when the rate was 14%. Nevertheless, the rate remains substantially higher than pre-pandemic when the rate was 11.7% in H1 2019.

Conclusion

Retailing remains hugely challenging, especially for smaller operators who have to service a higher debt burden than before the pandemic and some who are facing sharply higher interest costs. The cost-of-living crisis may be abating, but retailers face ongoing issues. At the top-line, many consumers are still curbing their spending, and at the bottom-line, retailers struggle with rebuilding their profit margins after a period of restraint caused by public pressure to limit the amount of cost inflation they could pass on to customers.

Our financial risk analysis highlights that the sector’s finances are significantly weaker than eighteen months ago. The greatest vulnerability is heavily focused on smaller retail businesses, but there will be further failures among high-profile brands. The keys to success remain the same:

- operational and strategic flexibility;

- adequate funding;

- good management;

- great internal and external communications;

- top quality customer service; and

- a sound business model.

If you would like to discuss any of the points in the report or believe you have been affected by any of these issues, you can speak to one of our Partners who can discuss options with you.

We have offices nationwide and by contacting us on 020 3326 6454, you will be able to get immediate assistance from our Partner-led team.