Is the business community and entrepreneurship an increasing force within the UK economy? The current UK Government’s top economic priority since it came to power has been generating growth in an economy that by any judgment, has struggled for many years to match the performance of most, if not all of its major competitors. The reasons are various, some of which are outside the control of any national government, but the outcome continues to disappoint. Current GDP predictions from the likes of the OBR and the IMF for 2025 are coming in at around 1% and not much higher for 2026.

This raises a couple of questions:

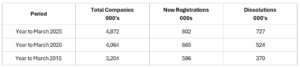

- Why is the number of annual new company registrations at Companies House now 20% higher in 2024/25 than pre-pandemic in 2019/20 and 37% more than ten years ago in 2014/15?

- Why have 2.49m new companies been registered at Companies House in the last three years, when business failures have been at record high levels?

Statistics

Companies House

The latest figures for the population of incorporated businesses published by Companies House show the following trends:

This suggests that the business community and its gallant entrepreneurs are an ever increasing force within the economy, despite savagely hard times during the pandemic, the ripple effect of the war in Ukraine, rampant inflation, higher interest rates and the cost of living crisis.

Nevertheless, other statistics give some pause for thought about what is driving the inexorable rise of incorporated businesses.

VAT registrations

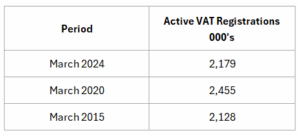

The latest data from HMRC on the number of active VAT registrations shows a different trend:

Given the current VAT registration level for annual turnover of £90,000, the implication of this flat trend compared to a decade ago is that the growth in the number of companies is heavily concentrated at the small and micro entity end of the SME size range.

Research briefing on private sector businesses

Not all UK businesses are incorporated, so it’s worth comparing the Companies House data with a research briefing on the population of private sector businesses published in November 2024 in the House of Commons Library. This shows a quite different trend:

It appears that while incorporated businesses have soared in the past decade, the absolute number of entities has remained static. The obvious reason for this is the move from self-employed to limited company status, partly driven by the gross uncertainty caused by the pandemic, but more by the long-standing IR35 campaign by HMRC to limit the use of self-employed status to reduce Income Tax and National Insurance liabilities.

This research also confirmed that 99% of all private businesses are SMEs with fewer than 250 employees.

Employer status

The House of Commons research highlights just how many businesses have no employees and by definition do not operate a PAYE scheme, reflecting in large part how restricted their activities are:

- Looking back to 2000, 32% of all UK businesses employed staff (even if it might only be their Directors).

- By 2024, this had fallen to only 26% and 74% had no employees at all.

The percentage with staff had fallen to 23.6% in January 2020, but this has since been somewhat reversed as a result of business owners changing their status to employees to take advantage of the Coronavirus furlough scheme and then sticking with their decision after the pandemic and the scheme ended.

Solving the Limited company surge puzzle

The data on new company registrations, VAT registrations and private businesses are sending conflicting messages. If the UK economy is bumping limply along the bottom, VAT registrations are back to where they were pre-pandemic and the overall number of businesses is static too, why has there been such a huge surge in new companies?

- One clue may be in the VAT registration statistics and the low percentage of businesses with employees, both of which suggest the new companies are predominantly very small entities, possibly established by staff striking out on their own after losing their jobs during the pandemic. This could be seen as a fragmentation of the economy.

- Another key factor is undoubtedly the success of HMRC in forcing the self-employed to incorporate.

- The final major influence could be a greater awareness of commercial and financial risk generated during the endless stream of major challenges faced by entrepreneurs since the start of the pandemic. This has made the protection of limited liability seem the more attractive business constitutional model.

Cynics might also point to the escalating problem with the creation of huge numbers of ‘sham’ companies to facilitate fraud and money laundering by organised crime gangs, but the scale of this problem is by definition, very difficult to assess with any accuracy.

If you are seeking professional advice for your business, Opus is here to help. You can speak to one of the members from Opus, who can discuss options with you. We have offices nationwide and by contacting us on 0203 995 6380, you will be able to get immediate assistance from our Partner-led team.