How will the struggling retail sector cope with major business rates and minimum wage rises?

The retail sector is crucial to the UK economy. It generates 6% of our GDP, receives a third of all consumer spending and employs 2.9m people (around 10%

The retail sector is crucial to the UK economy. It generates 6% of our GDP, receives a third of all consumer spending and employs 2.9m people (around 10%

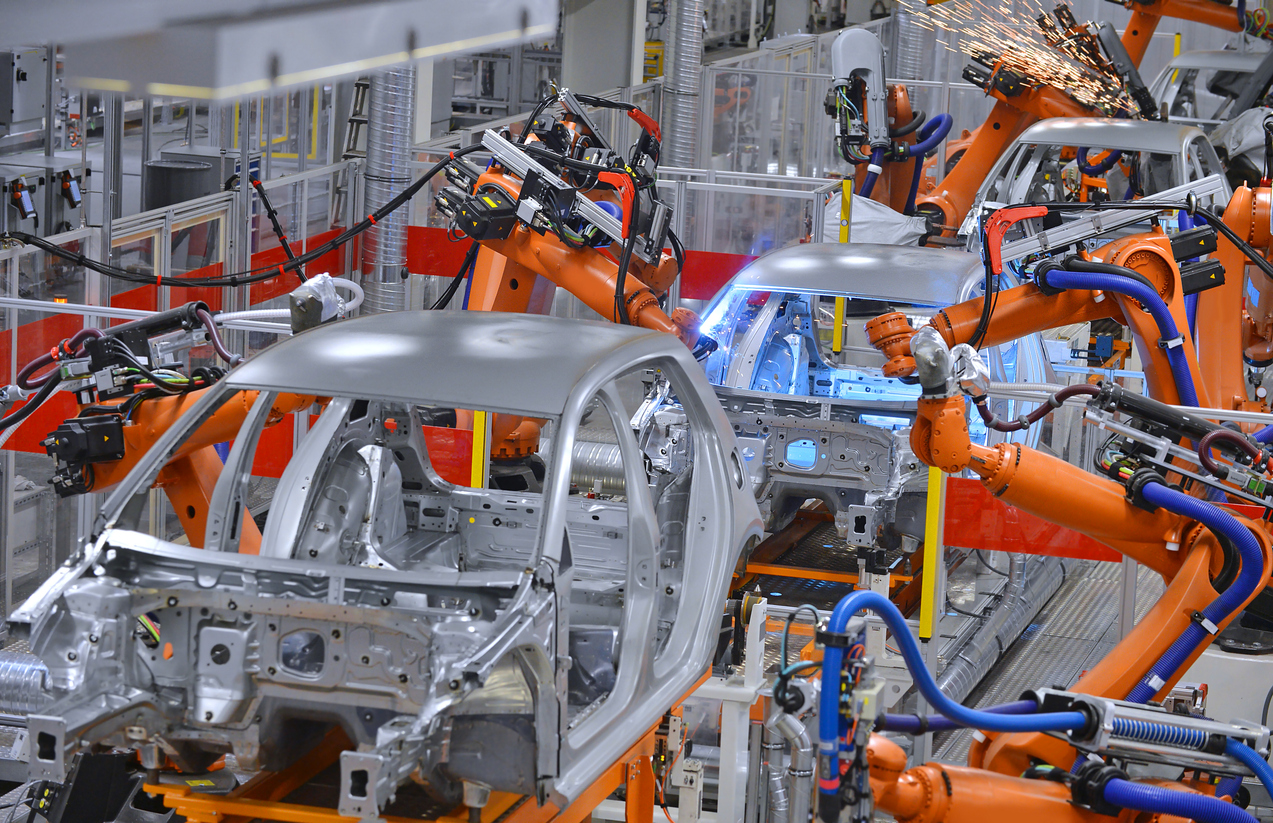

Manufacturing was once the bedrock of the economy and the source of the UK’s rise to economic superpower status in the 18th and 19th centuries. Since Margaret Thatcher

The UK economy appears to be on a slow upward trajectory in 2024 after a rocky start and on the back of a tough business landscape in 2023.

Current financial pressures In a letter to Chancellor Jeremy Hunt ahead of the March 2024 budget, the Local Government Association (LGA) said that councils were facing significant shortfalls

The signs are that the worst of the cost of living crisis may be over for consumers, with CPI inflation at 3.4% in February now well below the

Green shoots of recovery or another false dawn? The chart of the UK’s monthly GDP movement over the past thirteen months, published in mid-March by the Office for