Executive summary

- 2023 was a disrupted year for the construction sector, starting well but hitting turbulence in the second half. There are widely differing views on what 2024 will bring.

- The financial profile of the industry ended 2022 much improved from a year earlier but with clear vulnerabilities among smaller companies. It remains to be seen what 2023 did to the sector’s finances.

- Decades old challenges remain unresolved for the construction sector, but testing new ones have emerged in the areas of technology, sustainability and diversity.

Market characteristics

Construction GDP was £131bn in the twelve months to September 2023 according to analysis compiled by Trading Economics. This was a rise of 4.7% compared to the same period to September 2022. This represents some 6% of total UK GDP.

The industry employed some 2.15m people in Q2 2023, according to data from Statista, equivalent to some 7% of the labour force. This compares with the pre-pandemic level of 2.3m in Q1 2020 and the peak over the past twenty-five years of 2.6m in Q3 2008.

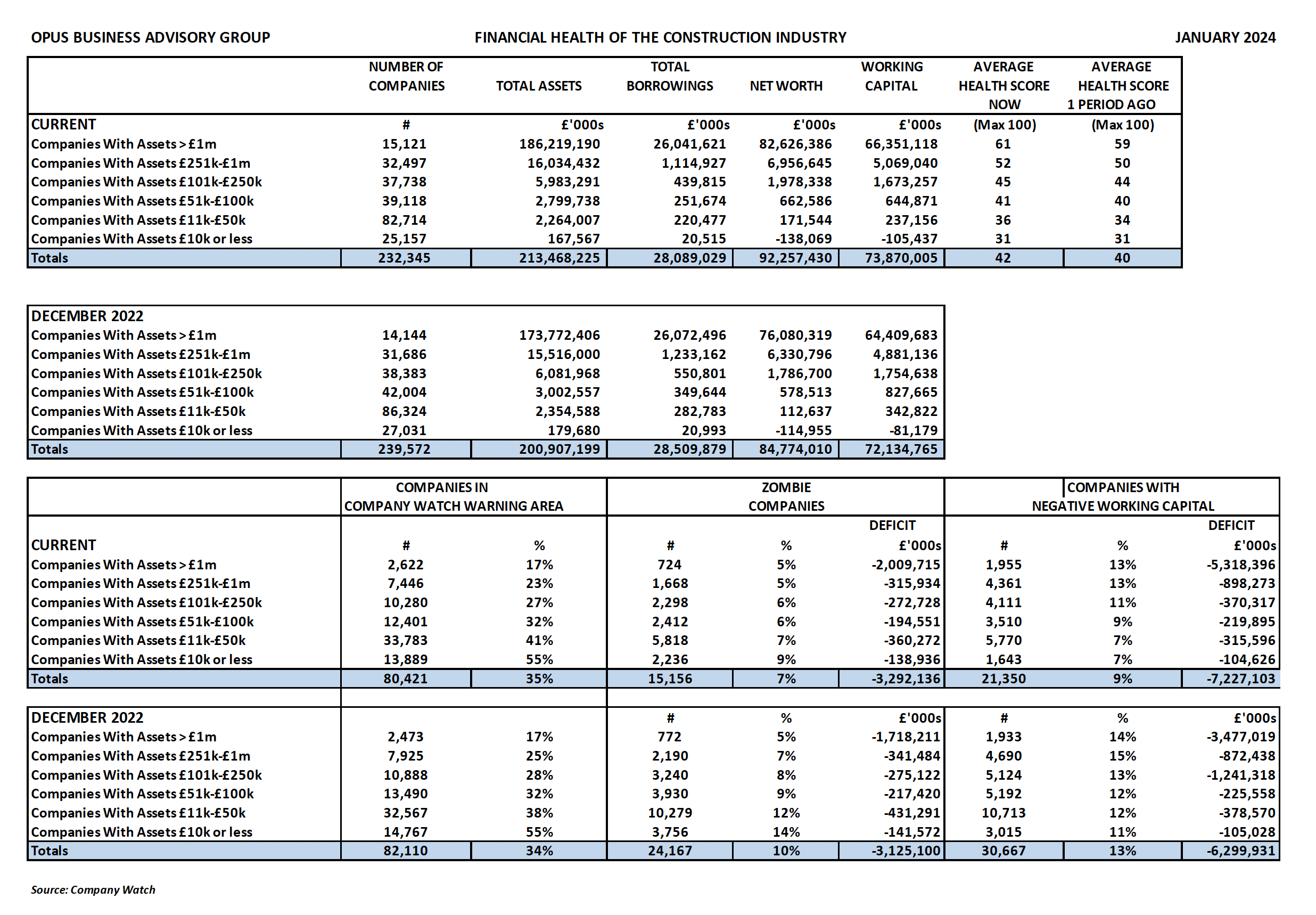

The total assets employed in the construction sector are now over £213bn, with a total net worth of £92bn. The sector borrows £28bn overall.

Current market conditions

Construction output fell by 0.6% in the three months to November 2023 according to the ONS, caused by a sharp fall of 3.6% in new work (mainly in the private housing and infrastructure sub sectors) outweighing a 3.8% increase in repair and maintenance, which contributes less to overall output. Anecdotal evidence suggests that adverse weather may have been the primary cause, although the November fall continues a downward trend in construction activity stretching back several months.

Prospects for 2024

The latest Construction Products Association (CPA) forecast for 2024 reflects the deteriorating outlook for construction output this year. In July 2023 the CPA was predicting 0.7% growth. In October 2023 this was revised sharply downward to a 0.3% fall. Now it is looking for a major reduction of 2.1% in 2024. It cites the two largest construction sub sectors (private housing new build and repair, maintenance and improvement) as the main losers and blames higher interest rates.

Looking at major sub sectors, the CPA is calling the following falls in output in 2024:

- Private house building – down 4%

- Private housing RMI – down 4%

- Infrastructure – down 0.5%

The good news is that these reductions are expected to be reversed by more or less matching output growth in 2025.

On the other hand, there are more optimistic views. The Glenigan Construction Industry Forecast 2024/25 suggests a surge of 8% in output in 2024 and 7% in 2025, basing its view on a strengthening UK economy.

Financial risk profile

For this report, we have used the database maintained by the financial health monitoring company, Company Watch, to analyse the latest published accounts of each of the 232,345 companies registered at Companies House as operating in the sector.

We were able to examine the most up-to-date financial data available and compare this with what we had found when we last looked at the construction industry in December 2022. Because of the delays in the filing deadlines at Companies House, the latest data mainly covers financial statements for trading periods ending in the second half of 2022.

A summary of our findings can be found here.

The headline findings reveal a marked improvement in the financial profile of the sector in just over a year since December 2022, although with some exceptions:

- The average Company Watch health rating (H-Score®) has improved from 40 to 42 out of a maximum of 100.

- The number of companies in the Company Watch warning area has risen from 34% to 35%

- Total assets have risen from £210bn to £213bn despite a 3% drop in the number of companies.

- Total borrowings have fallen by just over £400m.

- Total net worth has improved from £85bn to £92bn.

- The number of ‘zombie’ companies with negative balance sheets is sharply lower at 7% compared to 10%, although their combined shortfalls have increased slightly.

- The number of companies with negative working capital is also well down at 9% compared to 13%; again, their working capital deficit is significantly higher.

We look at the key statistics headlined above in more detail below.

Company Watch warning area

Over a third of companies (80,421) of the companies were in the Company Watch warning area with an H-Score of 25 or less out of a maximum of a hundred. Statistics for the past twenty-five years confirm that at least one in four of these businesses will fail or need a major financial restructuring during the next three years.

Debt levels

Overall borrowings have fallen from £28.5bn in December 2022 to £28.1bn in our latest research. Equally, debt levels have fallen in every one of the six company size ranges we examined, so that there has been an improvement from the very largest right down to the smallest construction businesses. Gross gearing and net gearing levels are modest at 13% and 30%, respectively. These figures are down from 14% and 34% in December 2022.

‘Zombie’ companies

7% (15,156) companies are zombies, with negative balance sheets where liabilities exceed assets by at least a de minimis figure of £20,000. Their combined balance sheet deficits add up to £3.3bn. In December 2022, 10% of the companies were zombies, so this risk indicator has improved, but the combined balance sheet shortfall is worse by some £167m.

Negative Working Capital

We also looked at the working capital position of those construction businesses where ‘quick’ current assets such as receivables, cash, contract value and work in progress were lower than their short-term liabilities. We found that 9% (21,350) of the companies had negative working capital of at least our de minimis figure of £20k, with a combined deficit of £7.2bn. In December 2022, there were 13% (30,667) with negative working capital totalling £6.3bn. Despite the improvement, this is not a healthy statistic for the industry, indicating significant scope for short term financial pressure.

Size matters

Our recent reviews in other sectors have revealed a major discrepancy between larger businesses and their smaller, less well-capitalised brethren. Accordingly, we have stratified our analysis, segmenting the sector into six size ranges according to total assets per company. The varying outcomes for the various size categories are set out in the summary of our results below.

The contrast between the major players and small businesses is stark. The average H-Score for construction entities with assets of more than £1m is 61 out of a hundred, against the sector average of 42. But for the very smallest businesses, the average is almost halved at only 31.

The fragmentation and financial fragility of the sector is also apparent from the startling statistic that almost half of construction companies (107,871) have total assets of £50k or less and more than one in ten (25,157) have total assets of £10k or less.

Of the small companies with assets of £50k or less, a deeply worrying 44% (47,672) are in the Company Watch warning area.

Business failures

Financial stability can be elusive for many construction businesses. Year and year out, in good times and bad, around a fifth of all UK insolvencies have been construction companies. This is in stark contrast to its far lower 6% share of GDP.

2023 turned out to be a record year for corporate insolvencies, with the total of 26,595 just eclipsing the previous modern day record of 26,556 at the height of the global financial crisis in 2009. There were 4,191 construction company insolvencies in the UK in the first eleven months of 2023, 17% of the total for the period.

This is welcome improvement from 19% in 2022, but sadly this reflects problems elsewhere in sectors like hospitality and retail, which were badly affected by the cost of living crisis, rather than any reduction in the financial vulnerability of the construction sector.

The major issues for construction in 2024 and beyond

As with most sectors, construction faces a cocktail of challenges stretching through this year and the next. Some are old chestnuts, which have plagued the industry for decades. Others are newer and require innovative and radical thinking and action. None are easily or quickly solved. These issues include:

- Variable activity levels: if the CPA are correct, 2024 will see a shortfall of workload, if Glenigan have called it right there may be capacity issues. Either way, there will need to be discipline in only accepting profitable work at realistic margins that can be funded from existing cash resources.

- Wafer thin profit margins: with continuing input cost inflation and endemic excess competition, the sector may spend yet another year talking about improving margins but ending up chasing volume through suicide bidding.

- Supply chain abuse: The ability to pass financial burden down the supply chain from larger companies to small ones and sub-contractors goes some way in explaining why the construction sector continues to top the charts for insolvencies year after year.

- Labour and skills shortages: According to the RICS UK Construction Monitor for Q4 2023, labour shortages have eased from the highwater mark a couple of years ago when around 80% of respondents reported a challenge in hiring. The result in the latest survey is still close to 50%. In addition, skill shortages in specific areas still remain acute. Roughly the same proportion point to shortages of both quantity and building surveyors and an even higher share identify problems around skilled trades.

- Rising input costs: despite a slowing in cost inflation, the specialist construction consultants, Turner & Townsend, have reported that 69% of UK construction companies identify cost rises as having a medium-to-major impact on projects. Maintaining strong supplier relationships and improving data collection through construction technology will be key to tackling cost issues in 2024.

- Digital transformation: like every other sector in the economy, construction is having to come to terms with a revolution driven by the breakneck development of AI technology and machine learning. This is affecting every aspect of its operating models, workflow planning management and performance monitoring.

- Diversity & inclusion: only 16% of the construction workforce were women in Q2 2023 and there are no statistics for the numbers of people identifying as neurodiverse. This is the subject of increasing public scrutiny and potential criticism. Solutions will be both difficult and long-term, but will become an increasing priority for the sector.

- Sustainability: there was a time when ESG issues were the preserve of academics and politicians. Now climate and other environmental activism has pushed them far higher up the priority lists of business leaders. Enlightened construction businesses are already working hard to make these considerations a core part of their objectives, to some extent driven by pressure from investors and clients. More need to follow their example.

The way forward for the construction sector

This will be a tough year for those running construction businesses, although at least they started an equally difficult year in 2023 with stronger finances than a year earlier. It will remain to be seen what the disruption to key sectors such as house building in 2023 has done to balance sheets and working capital resources.

This year will be another one of uncertainties, not just over the diverse views on likely activity levels but the potential for global geopolitics to move the UK’s economic goal posts yet again. Steady as she goes seems an appropriate policy, with an even more intense focus on financial discipline and risk awareness.

January 2023

If you would like to discuss any of the points in the report or believe you have been affected by any of these issues, you can speak to one of our Partners who can discuss options with you.

We have offices nationwide and by contacting us on 020 3326 6454, you will be able to get immediate assistance from our Partner-led team.