Executive Summary

- Unprecedented challenges for both state-funded and independent schools.

- Continuing political uncertainty in advance of the general election and its potential consequences.

- Strong financial data for both primary and secondary schools.

- Demographic predictions suggest a substantial reduction in pupil numbers in the years ahead, reflecting the falling UK birth rate.

- Technology and specifically AI will play an increasing role in education.

Current market conditions

It has been decades since the UK state education sector has sailed in calm financial waters. State-funded schools have suffered consistent under-funding, leading to significant under-investment, in particular as regards spending on the maintenance and renewal of premises. This has been highlighted by the RAAC crisis, which broke in 2023 and is very far from being resolved for the many schools affected.

The situation has been adversely impacted by local authorities’ increasingly parlous finances and the downsides of restrictive Private Finance Initiative (PFI) contracts, which govern many aspects of school management and make cost-cutting difficult.

There is a major crisis in teacher recruitment and retention, with alarming statistics on job vacancies and teachers planning to either retire or leave education altogether.

Inflation has eroded the adequacy of school budgets in both the state and private sub-sectors, while the cost of living crisis is affecting pupil numbers, fee incomes and the viability of marginal independent schools.

Prospects for 2024

The keyword for the year ahead is ‘uncertainty’.

With the nation’s finances in such a poor state and weeks of political promises as the general election approaches, it is impossible to tell what the financial and commercial landscape of our schools will look like by the end of the year, never mind into 2025.

What is a reasonable assumption is that the picture will not be materially better, so ‘caution’ needs to sit alongside uncertainty as a guiding reality for those who run schools.

Market characteristics

Statistics from the Department for Education published in November 2023 reveal the following key data for state-funded schools for the academic year 2022/23:

- 29,616 maintained schools

- 1m pupils

- 567k full-time equivalent teachers (FTE), out of

- A total workforce of 974k FTE staff

Equivalent data for Independent Schools shows:

- 2,555 schools

- 554k pupils (7% of all school-age children)

- 18% of pupils are aged 16 or over

- 76k FTE teachers

The financial parameters of the combined primary and secondary school sectors are:

- Total assets of £75bn

- Borrowings of £1.6bn

- Net worth of £66bn

Financial risk profile

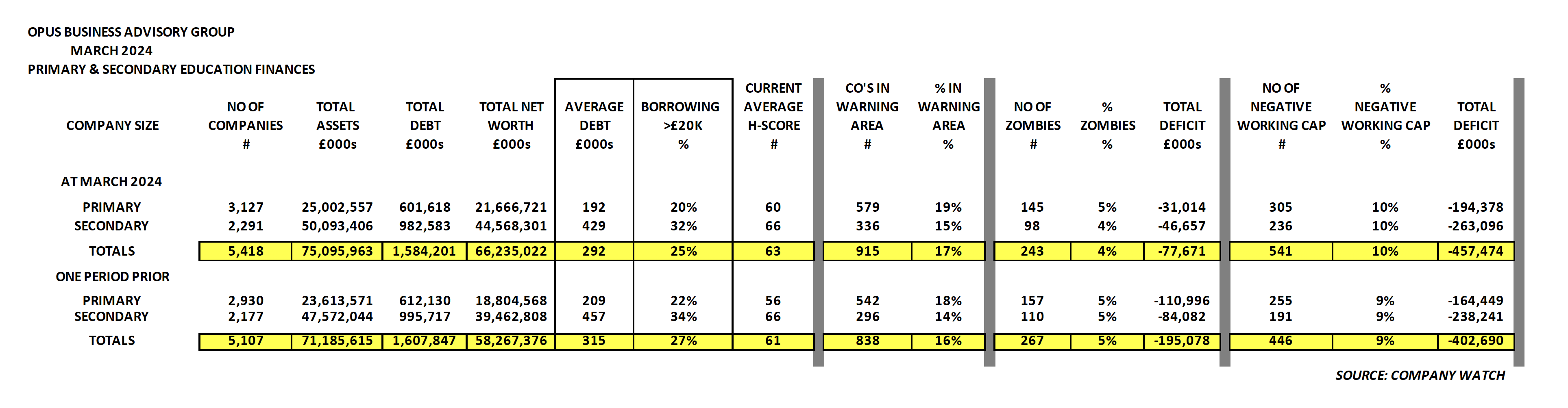

We have used the database maintained by the financial health monitoring experts, Company Watch, to analyse the latest published accounts of each of the 5,418 companies registered at Companies House as providing primary or secondary education services. This analysis does not include companies solely providing nursery or childcare facilities.

We were able to examine the most up-to-date financial data available, but because of the delays in the filing deadlines at Companies House, the latest data mainly covers financial statements for accounting periods ending in the second half of 2022 and first half of 2023.

A detailed analysis of the data can be found below:

The headline findings reveal generally strong finances, but with some deterioration in certain key stress indicators since the previous year’s results and also improvements in others:

Primary education:

- The average Company Watch financial health rating (H-Score®) has improved from 56 to 60 out of a maximum of 100. This is significantly better than any other industry sectors we have analysed in the past year.

- But the number of companies in the Company Watch warning area has risen marginally from 18% to 19%, confirming increasing financial stress among primary schools.

- Total assets have risen by 6% from £23.6bn to £25bn, indicating continuing investment.

- Total borrowings are stable at around £600m, but the percentage of companies who carry debt (more than £20k) has dropped from 22% to only 20%.

- Total net worth has improved significantly by 15% from £18.8bn to £21.7bn.

- 5% of primary school providers are ‘zombie’ companies with negative balance sheets and a combined shortfall of £31m. A year previously, the shortfall was £111m.

- The number of companies with negative working capital is 10% (up from 9% a year ago), with a higher total deficit of £194m against £164m previously. This is another indicator of the worsening financial health of some primary school companies.

Secondary education:

- The average Company Watch financial health rating (H-Score®) is stable at 66 out of a maximum of 100. This is very significantly better than any other industry sector we have analysed in the past year.

- But the number of companies in the Company Watch warning area has risen marginally from 14% to 15% since the previous accounts, confirming increasing financial stress among secondary schools.

- Total assets have risen by 5% from £47.6bn to £50.1bn, indicating continuing investment.

- Total borrowings are stable at just under £1bn, but the percentage of companies who carry debt (more than £20k) has dropped from 34% to 32%.

- Total net worth has improved significantly by 13% from £39.5bn to £44.6bn.

- 4% of primary school providers are ‘zombie’ companies with negative balance sheets and a combined shortfall of £47m. A year previously, the shortfall was £84m.

- The number of companies with negative working capital is 10% (up from 9% a year ago), with a higher total deficit of £263m against £238m previously. This is another indicator of the worsening financial health of some secondary school companies.

Company Watch warning area

Across the two categories, 17% (915) of the companies were in the Company Watch warning area with an H-Score of 25 or less out of a maximum of 100. Statistics for the past twenty-five years confirm that at least one in four of these school businesses will fail or need a major financial restructuring during the next three years, which means that some 229 primary or secondary school businesses are at serious risk of failure.

This percentage is much lower than in other sectors we have reviewed recently, such as construction, retail, hospitality, or manufacturing. This, along with the unusually high average financial health rating, may well reflect two key factors. The first is that many of the companies are subject to the tighter financial disciplines imposed by Charities Commission regulatory and financial reporting regime. The second may be the role played by Boards of Governors in the supervision of schools.

Debt levels

Borrowings are not a significant factor at a total of only £1.6bn, marginally down from a year previously. This represents gross gearing against total assets of a tiny 2% and the same negligible level of net gearing against net worth.

‘Zombie’ companies

4% (243) of the companies are zombies, with negative balance sheets where liabilities exceed assets by at least a de minimis figure of £20,000. Their combined balance sheet deficits add up to £78m. A year earlier, 267 (5%) of the companies were zombies with higher combined shortfalls of £195m, so this risk indicator has improved.

Negative Working Capital

We also looked at the working capital position of those firms where ‘quick’ current assets, such as receivables and cash, were lower than their short-term liabilities. We found that 10% (541) of the companies had negative working capital of at least our de minimis figure of £20k, with a combined deficit of £457m. A year previously, there were 9% (446) with negative working capital totalling £402m. These are not healthy statistics for the sector, indicating scope for short-term financial and cash flow pressure at the companies concerned.

Business failures

Insolvency Service data on school company insolvencies show very low levels of formal failures of school businesses. There is no detailed analysis for Scotland or Northern Ireland, but there were only 52 insolvencies in England and Wales in the year to January 2024, of which 16 were of primary school companies and 36 of secondary providers.

These low levels also reflect the tight governance of most school businesses and the importance of preventing school closures in communities through rescues, or mergers with stronger nearby schools.

Major issues for primary and secondary education in 2024 and beyond

The sheer range and difficulty of the challenges facing these sectors is daunting, but among the most common and important are:

State-funded school businesses:

- Political uncertainty affecting funding decisions.

- The continuing RAAC crisis.

- Cost inflation

- PFI contract restrictions.

- Staff recruitment and retention.

- Rapid technological change, most particularly the breakneck development of AI and digital transformation.

- Future demographic trends predicting falling pupil numbers.

- Mental health and wellbeing of staff and students, including the impact of social media.

- Discipline and absenteeism.

- Requirements for SEND pupils

- Maintaining pupil educational attainment.

Dealing with these issues will have major implications for the running costs of schools at a time when budgets are severely restricted.

Independent schools:

- Possible introduction of VAT on fees.

- Forthcoming increases in pension contribution costs for teachers in the Teachers’ Pension Scheme.

- Downward pressure on fee increases and falling pupil numbers from the cost of living crisis.

- Increased non-payment of fees.

- Cost inflation.

- Rapid technological change, most particularly the roller coaster development of AI and digital transformation.

The way forward

The differential between schools that are doing well and those that are struggling financially widened in 2023, a trend that can only continue through the remainder of 2024 and into 2025. There are difficult closure decisions ahead for some school businesses, either for their Governors or for the responsible local authorities.

Those responsible for the finances of schools need to be well on top of cash flow and expenditure, both in terms of control and forecasting. Where issues are identified, it is vital that they are addressed without delay and with the assistance of outside professional expertise where necessary. With the overwhelming demands and pressures on school management, outside assistance can prove invaluable when it comes to complex financial problem-solving and turnaround strategies.

If you would like to discuss any of the points in the report or believe you have been affected by any of these issues, you can speak to one of our Partners who can discuss options with you.

We have offices nationwide and by contacting us on 020 3326 6454, you will be able to get immediate assistance from our Partner-led team.