Executive summary

- The average financial health rating for the hospitality sector is only 31 out of 100, compared to the whole economy at 45. It has fallen from 33 in September 2023.

- Over half of hospitality companies are at serious risk of insolvency or a major financial restructuring over the next three years.

- 20% are ‘zombie’ companies with negative balance sheets. Their combined deficits total £2.2bn.

- 26% have negative working capital. Their combined shortfall is £7.4bn.

- Almost a third of hospitality businesses have total assets of less than £25k.

- Overall borrowings have risen 9%, but smaller companies have made significant debt repayments.

- Hospitality is the second worst-performing sector for insolvencies, accounting for 15% of all failures.

- Staffing issues remain a major problem, but vacancies are back close to pre-pandemic levels.

- Big rises in business rates and the National Minimum Wage in April 2024 will materially affect profits in the sector.

Introduction

After two years of lacklustre performance ending with a shallow recession in H2 2023, the UK economy is at last generating some positive news with inflation of 2.3% down close to the Bank of England’s target rate and GDP growth of 0.6% for Q1 2024. The Institute of Directors has just published its Economic Confidence Index for May 2024, which shows the highest level for almost three years.

Having battled through the pandemic, the hospitality sector’s latest challenge has been the cost of living crisis, which has savaged disposable incomes for millions of potential diners and drinkers. This factor remains an issue, but pay rises have been running consistently ahead of CPI inflation since the summer of 2023, which is beginning to ease the strain on household budgets.

Nevertheless, media and anecdotal comment on the sector remains dominated by tales of businesses struggling with falling profit margins, rising costs and labour shortages. There have been some hugely high-profile closures of iconic restaurants, such as La Gavroche, Pollen Street Social and Galvin at Windows.

To see how this public perception measures up with financial reality, we have analysed the latest published accounts of every pub, club and restaurant company in the UK for the fourth time in just over two years. Unfortunately, this research confirms that the deteriorating finances we found in our last sector report in September 2023 have slipped further downhill and by a significant amount.

Almost the only positive is the reduction of debt levels by smaller hospitality companies, but even then, the question is whether this has had to come at the expense of investment in quality standards, staff training, modernisation and upgrading of interiors, all of which is essential for the longer-term health of businesses in this sector.

We remain frustrated by the long delay allowed for filing accounts at Companies House, which means that at any point in time, accounting information in the public domain is between nine and eighteen months out of date. As such, we suspect that when we next carry out this analysis, the financial profile of hospitality is likely to be still darker and more troubling, even though the sector may, at last, be seeing the early signs of better times.

Market Characteristics

The hospitality sector accounts for 3% of the UK’s GDP or some £71bn in gross added value when accommodation output of £25bn is added to the activities of pubs, clubs and restaurants. This remains well below the pre-pandemic output of £104bn. It employed 3.2m people or 10% of the workforce before the pandemic, but this has fallen now to 2.5m. Our research shows that excluding accommodation-only businesses, it now deploys £54bn of assets, borrows £13bn and has an overall net worth of £15.4bn.

Research by Alix Partners in May 2024 shows that after stabilising in mid-2022, the hospitality market (excluding accommodation-only sites) has shrunk by 2.5%, with one in 40 venues closing in the year to March 2024 when measured by the number of UK licensed premises.

There are now 98,745 such venues. This is the first time the total has fallen below 100,000 since records began. The slightly more encouraging news is that there has been a very slight increase in venues in the first quarter of 2024, suggesting that the market may have stabilised. Nevertheless, the impact of the pandemic remains stark. There are now 23% fewer restaurant sites than in March 2020.

The worst-hit sub-sectors in the past year have been nightclubs (down 9.4%), large venues (down 6%) and sports/social clubs (down 3.5%). The only sub-sector to see an increase has been casual dining (up 0.7%).

The last 12 months have been a period of consolidation for the hospitality sector in city centres. Between March 2023 and March 2024 there was a net decline of only 1.3% of licensed premises—less than half the rate of 2.8% in towns.

Financial Risk Profile

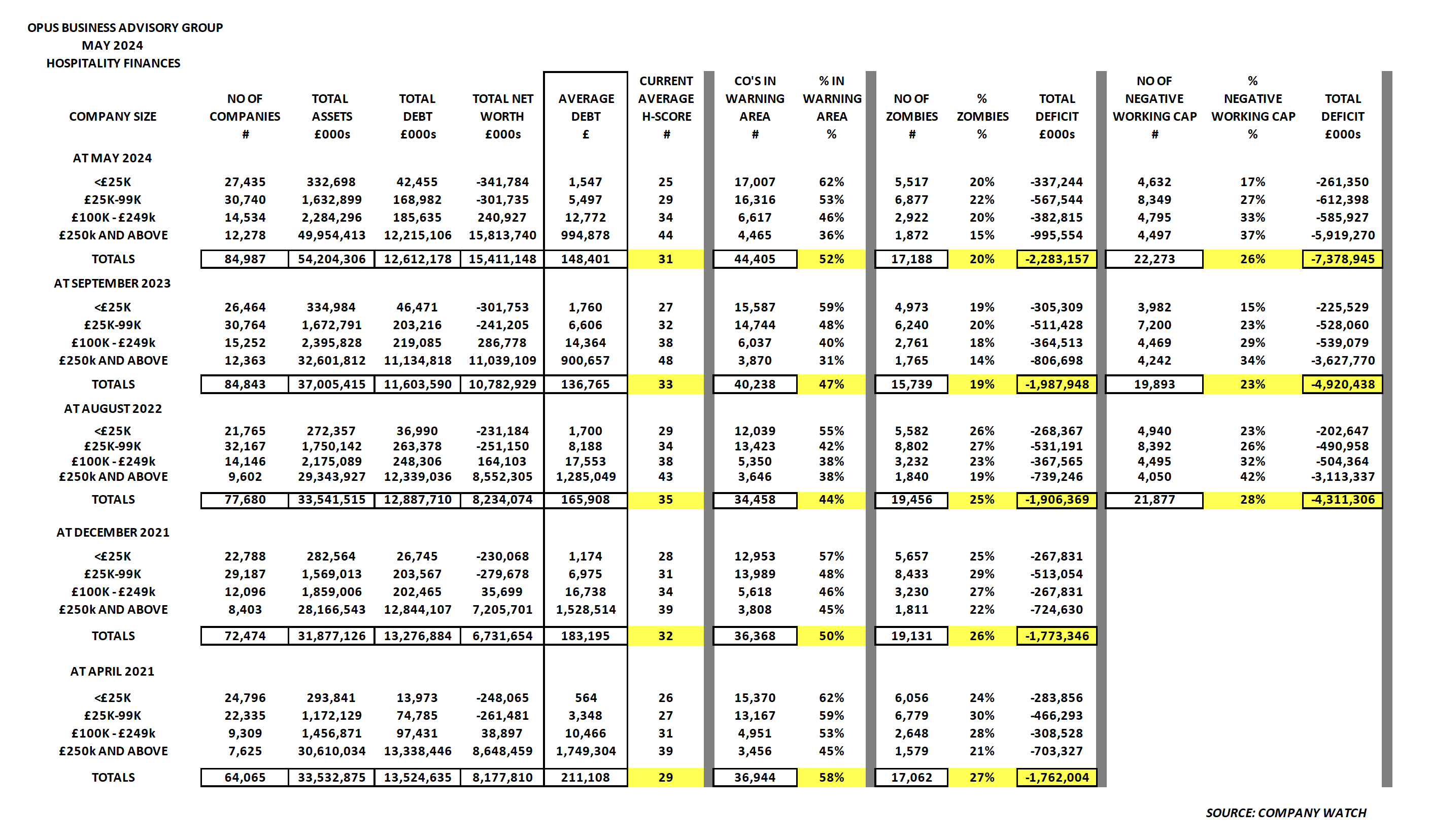

There are currently 84,987 companies registered at Companies House, whose business is recorded as running pubs, clubs or restaurants. We analysed their finances using the data analytical system at Company Watch, the financial health monitoring specialists. A summary of our research can be found below.

Overall Financial Health Score

Our analysis of the sector’s finances reveals that the average financial health score awarded by the Company Watch system (H-Score®) is only 31 out of a maximum of 100, compared to the whole economy where an average closer to 45 would be expected. Worryingly, this is down from 35 out of 100 in August 2022 and 33 in September 2023.

Vulnerable Companies

Over half of all hospitality companies (52% or 44,405) are in the Company Watch warning area with an H-Score of 25 or less. Historically going back some more than twenty years, this low level of H-Score indicates that one in four of these vulnerable entities will file for insolvency or undergo a significant financial restructuring during the next three years based on an analysis of their latest published accounts. This is significantly worse than in August 2022, when only 44% (34,458) were in the warning area and September 2023 when the figures were 47% and 40,238, respectively.

Zombie Companies

One in five (17,188) hospitality companies had negative balance sheets (of at least a de minimis figure of £20k). This is a deterioration since September 2023, when 19% (15,739) were zombies. Their overall combined deficits also continue to climb. This time, the shortfall adds up to £2.3bn, whereas it was £2bn in September 2023 and £1.9bn in August 2022.

Negative Working Capital

Another very worrying finding is that 22,273 (26%) of the companies have negative working capital of at least £20k. This means that their short-term liabilities due for payment in less than a year exceed their ‘quick’, easily realisable assets such as receivables, inventory and cash. This compares unfavourably with 19,893 (23%) with negative working capital in September 2023.

The overall working capital shortfall of these companies shows an even more alarming deterioration. It has shot up to £7.4bn from £4.9bn in September 2023 and £4.3bn in August 2022. A deficit position on working capital represents a vulnerable financial profile, so by any judgment, this is an undesirable and risky financial model in such difficult times for the industry.

Smaller hospitality businesses

Our analysis also confirmed how fragmented the industry is and how fragile some parts of it are, with 27,435 (32%) companies having total assets of less than £25,000. With financial fragility comes much greater risk. 62% of these micro businesses are in the Company Watch warning area and their average financial health rating is only 25 out of a maximum of 100. This is a marked deterioration from the 55% in the warning area and an average H-Score of 29 in August 2022.

Business failures

During the pandemic period, insolvencies in the sector were limited by various government support measures, in particular the furlough scheme and the ban on creditors issuing Winding Up petitions or landlords enforcing rent arrears. According to Insolvency Service statistics, there were 1,411 failures of pubs, clubs and restaurants in England, Scotland & Wales in the first seven months of 2022, which represented 11% of all corporate insolvencies.

There has been a clear acceleration of hospitality insolvencies in the past year. The twelve months to March 2024 saw 3,768 casualties, equal to 15% of all failures, a sharp increase. Only the construction sector has a higher percentage of insolvencies at 17%. This adverse trend will likely continue and probably worsen, given the extreme difficulties the industry has had to absorb over the cost of living crisis, rising input costs for materials and labour and the lack of any protection against savagely higher energy costs. For those businesses with debt, there are also higher interest costs to deal with, plus the significant rise in business rates and the national minimum wage from April 2024.

Debt levels in smaller hospitality businesses

The overall borrowings of the industry have risen by 9% to £12.6bn since September 2023, but that increase is confined to larger companies. For smaller entities, it is encouraging to see debt being paid down. Looking at average debt per company, the situation has improved for all sizes of hospitality businesses, except the very smallest:

- Assets of £250k or more – average debt up from £901k to £995k (a 10% increase)

- Assets between £100k and £249k – average debt down from £14.4k to £12.8k (down 9%)

- Assets between £25k and £99k – average debt down from £6.6k to £5.5k (down 17%)

- Micro entities with assets of less than £25k – average debt down from £1.76k to £1.55k (down 12%)

Despite these reductions, debt levels are still very significantly up on pre-pandemic levels for smaller companies as follows:

- Assets between £100k and £249k – up 22%

- Assets between £25k and £99k – up 64%

- Micro entities with assets of less than £25k –2.7 times higher

Staffing issues

Recruitment and retention of staff are still major issues for many hospitality businesses, with staff shortages often restricting opening hours. Less obvious is the effect that this problem is having on the quality of service that restaurants in particular are able to offer to their customers, which is unfortunate at a time when menu prices are being increased to recover at least some of the rampant cost increases of the past two years. The combination of higher bills and poorer service is not ideal as an incentive for diners to stay loyal.

Vacancies in the sector have come down from their peak of 176k in Q2 2022 and are now down to 107k in the three months covering February to April 2024. This is not far above the pre-pandemic level of 93k in the three months to February 2020. Despite these raw numbers, any suggestion that vacancies are anywhere near as easy to fill now as they were then would be met with derision in most hospitality settings.

Business Rates

A constant complaint is the sheer unfairness of the business rates burden faced by some business sectors, especially hospitality. Despite yet more promises from the government to reform this iniquitous system, the topic remains stuck deep in the political long grass.

As a result, the biggest year-on-year increase since 1991 came into force from the beginning of April 2024 as the standard multiplier used to calculate business rates went up by 6.7%. There is no precise figure for the overall hit to hospitality costs, but the industry is a major component in the Valuation Officer Agency’s ‘other’ category for business premises. It is estimated that this category will see an increase in its 2024/25 business rates bill of just over £500m.

National Minimum Wage (NMW)

The government’s reaction to the cost of living crisis has been a completely understandable decision to accept the recommendations from the Low Pay Commission (LPC) for a major rise in the various rates for the NMW. In broad terms, the hourly rate has gone up by around 10%, although for certain categories, the increase is over 20%.

Across the whole economy, the LPC believes that some 7% of workers are paid on the basis of the NMW. Unfortunately, this percentage is entirely different in hospitality. The LPC estimates that 46% of all employees in the industry fall into this category, which means that hospitality businesses have seen approximately 1.15m staff receive a 10% pay rise.

What now for hospitality?

The figures for hospitality openings and closings have long been a key indicator for judging the overall commercial health of the industry. The continued drop in sites under operation over the past twelve months is disappointing, but the fact that the latest quarter shows stabilisation and a marginal turnaround is a more positive sign. It suggests that the volatility of recent years may be easing.

M&A activity is rising, another sign that market pressures are diminishing. Increased deal flow is also being prompted by the prospects of a more transaction-friendly interest rate environment and consequently by increased access to debt to fund deals, even if it is more expensive than before the 2022 Autumn Mini Budget debacle.

It seems likely that all of this will move business valuations away from the lower levels driven by the perceived distress of the sector and back towards more normal considerations, such as operational performance and growth prospects. This is a far better scenario for small but ambitious restaurant groups looking to expand. Scaling up through taking on vacated sites is an attractive option now, especially as they are often available on more favourable rental terms than were previously available.

There remain major issues for poorly funded and inefficiently run hospitality businesses, especially those carrying too much debt. Certain specific sub-sectors are struggling with the combination of falling customer numbers and rising costs, notably nightclubs and larger venues with high fixed costs. All companies in the industry will feel the negative effect of the sharp rises in business rates and labour costs in April.

Nevertheless, confidence should grow if inflation and market interest rates continue to ease. In those circumstances, Q1 2024 may come to be seen as a turning point, and better times could follow for the hospitality sector.

If you would like to discuss any of the points in the report or believe you have been affected by any of these issues, you can speak to one of our Partners who can discuss options with you.

We have offices nationwide and by contacting us on 020 3326 6454, you will be able to get immediate assistance from our Partner-led team.