This is an industry where finances are already highly vulnerable

When we last provided a hotel sector report in July 2024, the UK economy appeared to have turned the corner with a positive first half after two distinctly average preceding years in 2022 and 2023. How quickly the nation’s finances and both business and consumer confidence can change. Our snapshot view of the economic prospects for 2025 shows a dramatically less rosy picture. A turgid second half of low growth and sticky inflation also saw a dramatic Budget, which imposed severe cost increases across the whole business community, but especially for heavily labour-intensive sectors, including the hotel industry.

Five years on from the onset of the pandemic, the significant disruption of those years has been replaced not just with cost increases in the Budget, but continued constraints on disposable income for potential UK guests. Sustained geopolitical uncertainty makes guessing foreign visitor trends beyond difficult and hopes for much needed interest rate reductions seem to change with the wind, or more precisely the whims of international bond markets. With such challenging factors at play, generating acceptable levels of return on investment remains uncertain for many hotel businesses.

Analysing the hotel sector data

In order to demonstrate the financial background against which the sector dealing with these complex issues, we have once again analysed the latest published accounts of every hotel company in the UK and compared the current position with equivalent data in July 2024 and September 2023. This research shows that the risk profile of the sector is poor overall and has deteriorated significantly since each of these dates.

Almost the only positive is the reduction of debt levels for the sector as a whole, but particularly by the largest hotel operators. Nevertheless, it remains a concern that this may have been achieved at the expense of the constant investment essential in the upgraded facilities and ever more interesting experiences expected by increasingly demanding guests.

Note

The long delay allowed for filing accounts at Companies House remains, which means that at any point in time, accounting information in the public domain is between nine and eighteen months out of date.

Market characteristics

Unfortunately, there is a noticeable lack of industry-wide data specific to hotels and similar accommodation. This vital information is generally subsumed amid the statistics for the hospitality sector as a whole. However, the UK hotel market is estimated to have been worth £24.3bn in 2024, down marginally on a figure of £24.7bn the year before according to the latest data published by Statista.

Our research for this report confirms that hotel operators in the UK have:

- Total assets of £39bn

- Borrow £11bn

- An overall net worth of £12.6bn

All of these statistics have fallen since both July 2024 and September 2023, indicating an industry that is shrinking rather than growing.

Estimates vary, but there are believed to be approximately 10,000 hotel businesses in the UK, although the number of individual hotels or hotel rooms remain unclear, as does the total number of people employed specifically in hotel businesses rather than in hospitality as a whole. Our research identified just over 7,000 companies registered in the UK, which claim to be hotel businesses. The difference will be accounted for in part by those businesses run as unincorporated entities and also by the difficulty some companies have in deciding whether they are running hotels that serve food and drink, or else pubs and restaurants with rooms.

Performance metrics

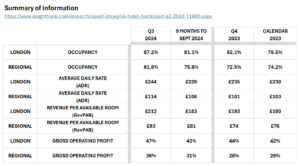

Using data published by Knight Frank, we have compiled a performance matrix comparing the latest data for the sector, split between the London market and regional hotels.

The improvement shown in almost all of the metrics for the nine months to September 2024 compared with calendar year 2023 are generally encouraging, although the static profit margins in the London market despite improved occupancy reflect a fall in the ADR and increased costs even before the Budget measures come into force in April 2025.

The figures for the latest quarter available to September 2024 are particularly strong but may have been materially impacted by the ‘Swift’ effect caused by the singer’s gigs in September 2024.

Financial risk profile

There are currently 7,110 companies registered at Companies House, whose businesses are recorded as running hotels or similar accommodation. We analysed their finances using the data analytical system at Company Watch, the financial health monitoring specialists. A summary of our research can be found here.

Overall financial health score

Our analysis of the sector’s finances reveals that the average financial health score awarded by the Company Watch system (H-Score®) is only 36 out of a maximum of 100, compared to the whole economy where an average closer to 45 would be expected. This is down from 37 in July 2024 and 39 in September 2023.

Vulnerable companies

Almost half of all hospitality companies (48% or 3,393) are in the Company Watch warning area with an H-Score of 25 or less. Historically going back more than twenty five years, this low level of H-Score indicates that one in four of these vulnerable entities will file for insolvency or undergo a significant financial restructuring during the next three years based on an analysis of their latest published accounts and other data. This is worse than in July 2024 and September 2023, when 46% and 45% respectively were in the warning area.

Zombie companies

More than one in five (22% or 1,567) hospitality companies had negative balance sheets (of at least a de minimis figure of £20k). This is a deterioration since September 2023, when 21% were zombies and the same percentage as in July 2024. Their overall combined deficits also continue to escalate. This time, the shortfall adds up to £2.4bn, whereas it was £2.1bn in July 2024 and £2bn in September 2023.

Negative working capital

An even more worrying finding is that 3,011 (42%) of the companies have negative working capital of at least £20k. This means that their short term liabilities due for payment in less than a year exceed their ‘quick’, easily realisable assets such as receivables, inventory and cash. This compares unfavourably with 1,762 (40%) with negative working capital in September 2023 but is the same percentage as in July 2024.

The overall working capital shortfall of these companies is lower than in September 2023 but higher than in July 2024. It is now £3.1bn compared to £2.9bn in July 2024 and £3.4bn in September 2023. A deficit position on working capital shows a vulnerable financial profile, so by any judgment, this is an undesirable and risky financial model for the industry.

It is particularly concerning to find that the smallest tiers of hotel business have a very high incidence of negative working capital. 34% of companies with total assets under £500k are in this adverse position, compared to 55% of those with assets between £500k and £5m and 53% of those with assets over £5m which are similarly afflicted. Larger companies with substantial assets may be using the ‘private equity’ style of funding, deliberately choosing to have high levels of debt rather than funding their business models with equity finance, but this is unlikely to be the case for smaller businesses.

Smaller hospitality businesses

Businesses with less by way of asset value in their balance sheets will obviously be at greater financial risk than larger and better capitalised entities. For hotel operators, 59% (4,210) have total assets of less than £500k. Their average financial health rating is just 31 out of 100, compared to 53 for those hotel businesses with total assets of £5m or more.

54% of these smaller companies are in the Company Watch warning area, 26% of them are zombies and 34% have negative working capital. The sole positive is that the average borrowings by smaller entities have fallen since September 2023 from £13,138 per company to £10,300 in their latest accounts.

Business failures

Fortunately, formal insolvency filings by hotel operators are currently and historically low. Total hotel insolvencies in England & Wales in the twelve months to November 2024 were 168. This represents only 0.6% of all corporate insolvencies.

Staffing issues

Although vacancy levels across the hospitality sector have fallen steadily for some time and at 90,000 are almost down to the immediate pre-pandemic level of 86,000, recruitment and retention of staff are still major issues for many hotel operators. Staff shortages can restrict the range of services offered by a hotel as well as the number of rooms, which can be serviced and therefore made available to guests.

Less obvious but probably more serious is the impact that this problem is having on the quality of service that hotels can offer their guests, which is unfortunate at a time when room rates are being increased to relieve some or all of the pressure caused by cost increases. This combination of higher bills and poorer guest experiences is not ideal as an incentive for guests to return in future.

Budget cost increases

The tax and other measures announced in the October Budget will be a hammer blow for many hotel operators as from April 2025, whether it is the increase in employers’ National Insurance contributions, the sharp rise in the National Minimum Wage or the reduction in the discounts available to some against their Business Rates liabilities.

Probably the most serious aspect is the impact on the cost of employing part time staff, where the reduction in the threshold at which employers must pay National Insurance on staff will bite hard.

Analysis by UKHospitality revealed that the employment tax measures in the Budget will increase the overall hospitality industry’s annual tax bill by £3bn. In particular:

- It will increase the annual labour cost of employing a full-time staff member working an average of 38 hours a week and earning the NMW by at least £2,500.

- It will be £2,100 more expensive to employ a single parent working 9am to 3pm, five days a week.

- It will be £1,140 more expensive to employ a student working 14 hours at the weekend.

What now for hoteliers?

The predictions for 2024 were divided sharply between optimistic and pessimistic opinions. In the end the actual outcome appears to have landed on the positive side of the debate. As we start 2025, the general view is upbeat but with some industry experts more cautious than others.

A good example are the forecasts from PWC, which are headlined “upbeat outlook, but downside risks remain”. In essence, the view is that while below average UK GDP growth of 1.6% in 2025 might reduce UK domestic business and leisure demand, falling UK interest rates and the resultant weakening pound could boost inbound tourism attracted by the relative affordability of the UK for international travellers.

A slightly less cautious view comes from RBH Hospitality Management in the Hotel magazine. Its summary concludes “from a renewed surge in investor confidence and expansion into untapped markets, to a growing focus on delivering authentic guest experiences and the strategic use of existing spaces to create additional rooms, 2025 looks set to drive profitability and create lasting value.”

The impact of the Budget cost increases on pricing and therefore on the key aspect of affordability may throw a frustrating spanner in the hotel works, as will any adverse trend in geopolitical events.

Priorities for hotel businesses

- How good is the performance data? Hotels are complex businesses so it is important to know promptly and accurately which parts are performing and which are not, so that appropriate remedial action can be taken.

- Can cash flow be improved by negotiating better terms with suppliers and improving collection of receivables where possible?

- Are there further operational efficiencies and cost savings, using technology where it can assist.

- How effective is the marketing, alongside the review of guest feedback. Social media remains a useful communication tool, both in terms of pulling in guests, new and returning.

- When reviewing the guest experience, it is good to consider the impact of technology at the reservation handling point, guest arrivals and in-room facilities. A delicate balancing act as not every guest is tech savvy, but equally every guest will appreciate the better understanding of their preferences that some technology can bring.

- Ensuring a robust but efficient rolling forecasting process that focuses on significant variances from budgets as learning points, not a horror story distraction of excessive in-depth analysis by overworked management.

- Maintaining open communication and as strong a relationship as possible with all key stakeholders.

- Be open to calling in external expertise to help with problems. Few management teams have the breadth of knowledge and experience, never mind the bandwidth to cope with every challenge their business and external factors beyond their control may throw at them (in any sector). Managed well, such assistance will be a net benefit, not a cost.

If you would like to discuss any of the points in the report or believe you have been affected by any of these issues, you can speak to one of our Partners who can discuss options with you.

We have offices nationwide and by contacting us on 020 3326 6454, you will be able to get immediate assistance from our Partner-led team.