Executive summary

- The average financial health rating for the hotel industry is only 37 out of 100, compared to the whole economy at 45. It has fallen from 39 in September 2023.

- Almost half (46%) of hotel operators are at serious risk of insolvency or a major financial restructuring over the next three years.

- 22% are ‘zombie’ companies with negative balance sheets. Their combined deficits total £2.1bn.

- 42% have negative working capital. Their combined shortfall is £2.9bn.

- Overall, industry borrowings are static, but smaller companies have made significant debt repayments.

- Hotel business failures are not a major factor, accounting for only 0.6% of all UK corporate insolvencies.

- 2023 was a robust year for the industry in terms of key indicators (occupancy, ADR, RevPAR, GOPPAR) but there are concerns for performance in 2024.

- Staffing issues remain a major problem, but overall, hospitality sector vacancies are back down close to pre-pandemic levels.

- Big rises in business rates and the National Minimum Wage in April 2024 will materially affect profits in the sector.

- Technology, especially AI is playing an increasing role in shaping the guest experience and improving operational efficiencies.

Introduction

Following a distinctly flat performance in the past two calendar years culminating in the shallow recession of H2 2023, the UK economy is at last generating some positive news, with inflation finally dropping back to the Bank of England’s 2% target rate. GDP growth seems to have ground to a halt in the single month of April 2024, but was still 0.7% for the three months up to then. The Institute of Directors recently published its Economic Confidence Index for May 2024, which shows the highest level for almost three years.

Having battled through the pandemic, the hotel industry’s latest set of challenges has been the pernicious pincer effect on the profitability of the cost-of-living crisis (which is impacting top-line revenue), the cost-of-doing-business crisis (which is threatening profit margins), and high interest rates (which are ramping up the cost of servicing borrowings).

Whilst these negative factors look likely to ease at least partially in 2024, generating acceptable levels of return on investment remains to be determined for many hotel businesses.

Unlike the wider hospitality market and its high-profile restaurant closures, media and anecdotal comments on the hotel sector remain generally positive. To judge how financial reality matches this upbeat mood, we have analysed the latest published accounts of every hotel company in the UK and compared the current position with equivalent data in September 2023. This research shows that the sector’s risk profile is poor overall and has deteriorated significantly in less than a year.

Almost the only positive is the reduction of debt levels by smaller hotel operators, but even then, the question is whether this has had to come at the expense of investment in quality standards, staff training, modernisation, technology, and upgrading of the guest experience, all of which are essential for the longer-term health of businesses in this industry.

We remain frustrated by the long delay allowed for filing accounts at Companies House. This means that accounting information in the public domain is between nine and eighteen months out of date at any given time. As such, we suspect that when we next carry out this analysis, hospitality’s financial profile is likely to be worse still.

Market Characteristics

Unfortunately, there is a noticeable absence of industry-wide data on hotels and similar accommodation. This important information is generally buried within statistics for the hospitality sector as a whole. The size of the market is estimated to have been £24.7bn in 2023, up very significantly in 2022 when the continuing impact of the pandemic limited the market to only £16.4bn. Forecasts for 2024 vary, but the suspicion is that waning demand may produce a marginal reduction this year. However, our research for this report confirmed that hotel operators in the UK have total assets of £40bn, borrow £15bn and have an overall net worth of £12.9bn, making this a significant contributor to the economy.

Again, estimates vary, but there are believed to be just under 10,000 hotel businesses in the UK, although the number of individual hotels or hotel rooms remains a mystery, as does the total number of people employed in hotel businesses. Our research identified just over 7,000 companies registered in the UK that claim to be hotel businesses. The difference will be accounted for by those businesses run as unincorporated entities or the difficulty some companies have in deciding whether to run hotels or pubs and restaurants with rooms.

Financial Risk Profile

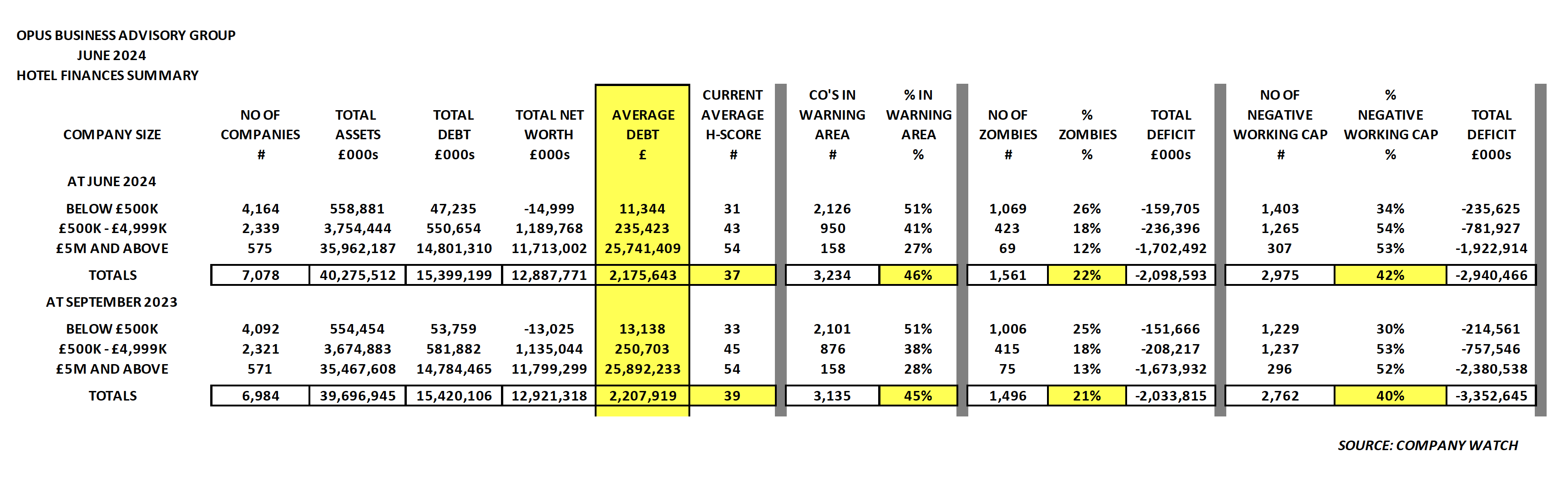

There are currently 7,078 companies registered at Companies House, whose businesses are recorded as running hotels or similar accommodation. We analysed their finances using the data analytical system at Company Watch, which is a financial health monitoring specialist. A summary of our research can be found here.

Overall Financial Health Score

Our analysis of the sector’s finances reveals that the average financial health score awarded by the Company Watch system (H-Score®) is only 37 out of a maximum of 100, compared to the whole economy where an average closer to 45 would be expected. This is down from 39 in September 2023.

Vulnerable Companies

Almost half of all hospitality companies (46% or 3,234) are in the Company Watch warning area with an H-Score of 25 or less. Historically going back more than twenty years, this low level of H-Score indicates that one in four of these vulnerable entities will file for insolvency or undergo a significant financial restructuring during the next three years based on an analysis of their latest published accounts. This is worse than in September 2023, when 45% (3,135) were in the warning area.

Zombie Companies

More than one in five (22% or 1,561) hospitality companies had negative balance sheets (of at least a de minimis figure of £20k). This is a deterioration since September 2023, when 21% (1,496) were zombies. Their overall combined deficits also continue to escalate. This time, the shortfall adds up to £2.1bn, whereas it was £2bn in September 2023.

Negative Working Capital

An even more worrying finding is that 2,975 (42%) of the companies have negative working capital of at least £20k. This means that their short-term liabilities due for payment in less than a year exceed their ‘quick’, easily realisable assets such as receivables, inventory and cash. This compares unfavourably with 1,762 (40%) with negative working capital in September 2023.

The overall working capital shortfall of these companies has at least fallen somewhat. It is now £2.9bn compared to £3.4bn in September 2023. Nevertheless, a deficit position on working capital represents a vulnerable financial profile, so by any judgment, this is an undesirable and risky financial model for the industry.

It is particularly concerning to find that the smallest tiers of hotel business have a very high incidence of negative working capital. 34% of companies with total assets under £500k are in this adverse position, while 54% of those with assets between £500k and £5m are similarly afflicted. Larger companies with substantial assets may be using the ‘private equity’ style of funding, involving deliberately having high levels of debt, but this is unlikely to be the case for smaller businesses.

Smaller hospitality businesses

Businesses with less by way of asset value in their balance sheets will obviously be at greater financial risk than larger and better capitalised entities. For hotel operators, 59% (4,164) have total assets of less than £500k. Their average financial health rating is just 31 out of 100, compared to 54 for those hotel businesses with total assets of £5m or more.

51% of these smaller companies are in the Company Watch warning area, 26% of them are zombies and 34% have negative working capital. The sole positive is that their average borrowings by smaller entities have fallen since September 2023 from £13,138 per company to £11,344 in their latest accounts.

Business failures

Fortunately, formal insolvency filings by hotel operators are currently and historically low. Total hotel insolvencies in England & Wales in calendar year 2023 were 144, exactly the same as in 2019 pre-pandemic. This represents 0.6% of all corporate insolvencies in 2023 and 0.8% in 2019.

Staffing issues

Recruitment and retention of staff are still major issues for many hotels as they are for hospitality businesses in general. Staff shortages can restrict the range of services offered by a hotel as well as the number of rooms, which can be serviced and therefore made available to guests. Less obvious but probably more serious is the impact that this problem is having on the quality of service that hotels can offer their guests, which is unfortunate at a time when room rates are being increased to recover at least some of the rampant cost increases of the past two years. This combination of higher bills and poorer guest experiences is not ideal as an incentive for guests to return in future.

Regrettably, there seem to be no comprehensive data for unfilled jobs at hotels, but overall hospitality sector vacancies have come down from a peak of 176k in Q2 2022 and are now down to 107k in the three months covering February to April 2024. This is not far above the pre-pandemic level of 93k in the three months to February 2020. Despite these raw numbers, any suggestion that vacancies are anywhere near as easy to fill now as they were then would be met with derision by most hotel management teams.

Business Rates

A constant complaint is the sheer unfairness of the business rates burden faced by some business sectors, especially hospitality and hotels. Despite yet more promises from the previous government to reform this iniquitous system, the topic remains stuck deep in the political long grass unless and until the new Labour regime rescues it and takes action.

As a result, the biggest year-on-year increase since 1991 came into force from the beginning of April 2024 as the standard multiplier used to calculate business rates went up by 6.7%. There is no precise figure for the overall hit to hospitality or hotel costs, but the industry is a major component in the Valuation Officer Agency’s ‘other’ category for business premises. It is estimated that this category will see an increase in its 2024/25 business rates bill of just over £500m.

National Minimum Wage (NMW)

The previous government’s reaction to the cost of living crisis was a completely understandable decision to accept the Low Pay Commission (LPC) recommendations for a major rise in the various rates for the NMW effective from the beginning of April 2024. In broad terms, the hourly rate has increased by around 10%, although the increase is over 20% for certain categories.

The LPC believes that 7% of workers are paid on the basis of the NMW across the economy. Unfortunately, this percentage is entirely different in hospitality and hotels. The LPC estimates that 46% of all employees in the industry fall into this category.

Investment in new hotel capacity

There is some concern among industry observers about the scale of new capacity coming on stream just as demand may be weakening. Consultants, PwC point out that London has seen the largest increase in supply since the lead up to the London 2012 Olympics, particularly of luxury high-end rooms. Meanwhile, new supply in the regions is almost twice the historic average level of 1% of new supply. This rate of increase across the UK prompts the risk of oversupply in some locations, in the short term.

Property experts, Knight Frank have published data showing elevated new hotel development levels right through 2021 to 2023 and confirming that 2023 saw a £2bn spend, adding 141 new hotels and 12,290 extra rooms.

What now for hoteliers?

There are clearly two schools of thought about the prospects for 2024.

Pwc forecasts foresee a weakening in demand in 2024, which will cause falls in occupancy levels and RevPAR in the regional market and only a very marginal increase in these measures, even in London.

By contrast, CBRE predictions suggest a much stronger market in 2024.

Both opinions can’t be correct, but it is to be hoped that confidence among consumers will grow now that inflation has fallen so far and with the likelihood of interest rate cuts coming soon, leading to better occupancy and more profitable outcomes for this year and beyond.

A priority action list for hotel businesses

- How good is the performance data? Hoteliers run complex businesses and must know promptly and accurately which parts are performing and which are not, so that appropriate action can be taken.

- Can cash flow be improved by negotiating better terms with suppliers and improving the collection of debtors where possible?

- Look for greater operational efficiencies and cost savings by using technology where it can assist.

- Review the effectiveness of marketing, with a particular focus on reacting to and understanding guest feedback. Social media is vital, both in terms of pulling in guests and staying on top of public opinion about the business.

- Critique the guest experience honestly and constructively, especially the impact of technology at the reservation handling point, guest arrivals and in-room facilities. Not every guest is tech savvy, but equally, every guest will appreciate the better understanding of their preferences that some technology can bring. It’s a balancing act.

- Have a robust rolling forecasting process that recognises variances from budgets as learning points, not a horror story distraction of excessive in-depth analysis by overworked management.

- Maintain open communication and as strong a relationship as possible with key stakeholders such as investors, lenders, suppliers, credit insurers and staff.

- Be open to calling in external expertise to help with problems. Management teams often have a limited breadth of knowledge and experience, never mind the bandwidth, to cope with every challenge their business and external factors beyond their control may throw at them. Managed well, such assistance will be a net benefit, not a cost.

If you would like to discuss any of the points in the report or believe you have been affected by any of these issues, you can speak to one of our Partners who can discuss options with you.

We have offices nationwide and by contacting us on 020 3326 6454, you will be able to get immediate assistance from our Partner-led team.