Like so much of the UK economy, manufacturing has been hit hard by the succession of recent financial and commercial shocks: Brexit, the pandemic, supply chain disruption caused by the Ukraine war, rampant input cost inflation and higher interest rates. After a strong start to 2024, the sector seems to have stumbled as domestic demand has fallen.

Financial headlines:

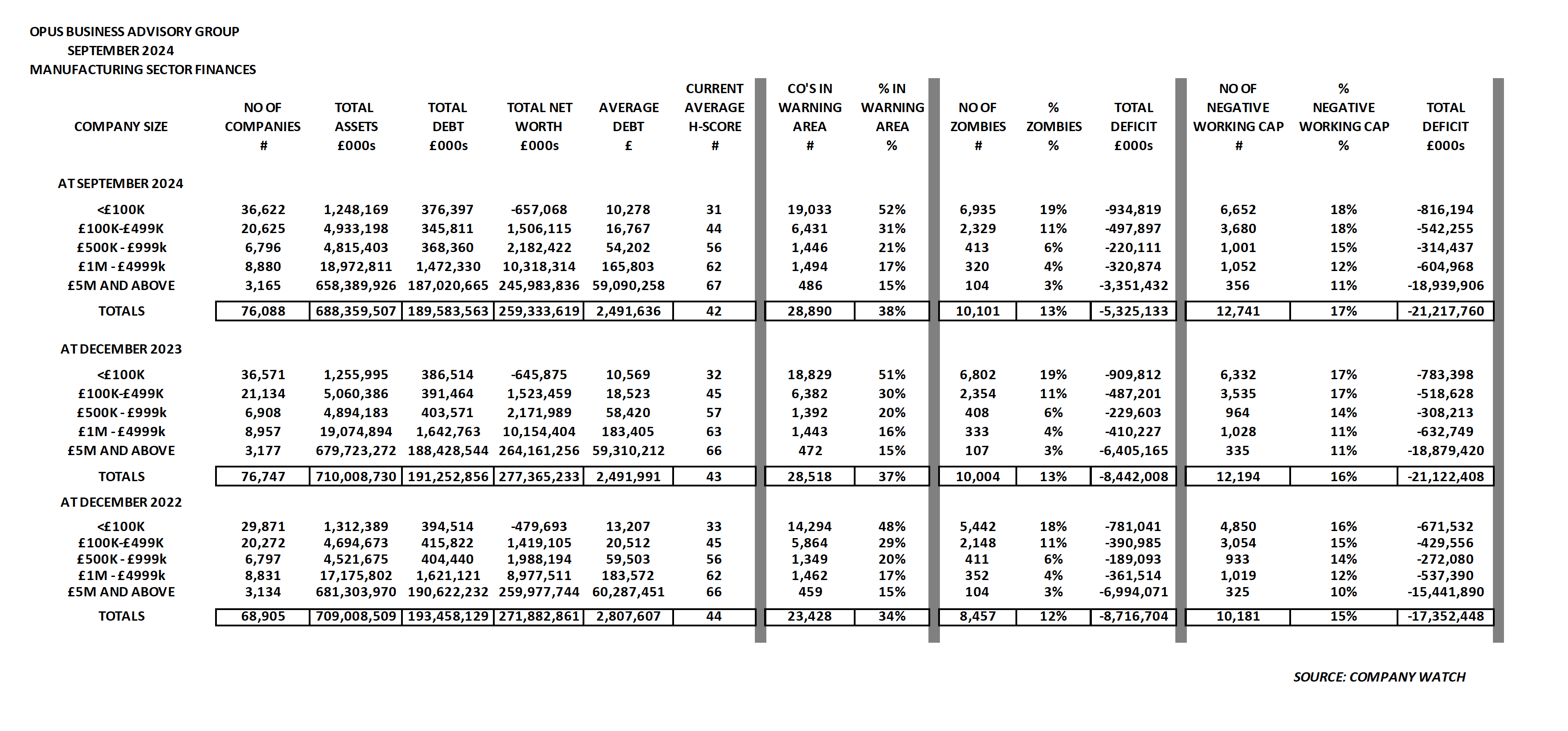

- Overall financial health has fallen from 44 out of 100 in December 2022 to 42 out of 100 now.

- Debt levels continue to fall, but only very marginally.

- Well over a third (38%) of manufacturers are at enhanced risk of failure or major restructuring.

- Over 10,000 manufacturers are ‘zombies’ with greater liabilities than the book value of their assets.

- One in six manufacturers (17%) operate with negative working capital.

The scale and scope of the sector

According to research recently published by MakeUK, key statistics for the manufacturing sector include:

- Gross value added is £217bn, some 9.3% of UK GDP.

- Manufacturing exports are 45% of the UK’s total exports.

- 6m people are employed in manufacturing, equivalent to 8.1% of the UK workforce.

- Manufacturing accounts for 47% of the UK’s total research and development spending.

- Business investment in the sector is £38.8bn or 14% of total UK investment.

Financial characteristics

The latest published accounts of the 76,088 manufacturing companies registered at Companies House show that they have combined:

- total assets of £688bn

- total borrowings of £190bn

- total net worth of £259bn

Financial risk profile

We have used the database and analytics maintained by the financial health monitoring specialists, Company Watch to review and then summarise the latest financial statements filed at Companies House by the 76,088 manufacturing companies registered in the UK. It should be noted that because of the extended filing timeline for accounts, the figures we have analysed will on average represent the financial trading and asset profiles of the businesses as they were around a year ago. A summary of our detailed analysis can be found below.

Overall financial health

Our manufacturing companies have an average financial health rating of 42, which is significantly below the economy as a whole where this rating is close to 50. This compares to an overall health rating of 43 in December 2023 and 44 in December 2022, the first of a series of adverse trends to be seen across a range of key financial indicators.

Failure risk

Our research highlighted another worrying statistic. Company Watch uses complex analytics to generate a financial health score (H-Score®) for companies out of a maximum of 100. An H-Score of 25 or less indicates that the company concerned has a one in four risk of going through a formal insolvency process or a significant financial restructuring leading to stakeholder losses during the next three years.

Out of our sample of 76,088 companies, 28,890 (38%) are in the Company Watch warning area with a score of 25 or less. Across the economy as a whole, the expectation is that no more than a fifth should be in this warning area. This is a clear warning sign on the financial fragility of the sector. The current high risk percentage compares to 37% in December 2023 and 34% in December 2022. This is a significant increase in financial risk in less than two years.

Borrowings

Fortunately, debt does not appear to be a major issue in the sector, with its total of £190bn borrowings representing gearing of only 28% against total assets and 73% against net worth, although both of those percentages are rising. Debt is reducing very slightly, coming down from £191bn in December 2023 and £193bn in December 2022. In terms of average debt per company of £2.49m, the improvement is extremely marginal compared to December 2023. Despite the improvement, there will be an impact on profitability and cash flow from ongoing higher interest rates, even with the expected rate cuts later this year and in 2025.

Zombie companies

In recent years, more and more companies have changed to utilising financing models where reliance on equity funding has been replaced by debt leverage. Across the economy as a whole, there are approximately 250,000 companies with negative balance sheets, where their liabilities exceed the value of their assets by a de minimis limit of £20k. These are often referred to as ‘zombie’ companies.

Our research shows that 10,101 (13%) of manufacturing entities are zombies. Between them they have combined balance sheet deficits totalling £5.3bn. In December 2023, the percentage was the same, although the overall deficit was higher at £8.4bn. In times of higher interest rates, dependence on borrowings as the principal funding for both working and fixed capital can be a burden that some companies find difficult to bear.

Negative working capital

Another modern-day dilution of traditional financial rectitude is the tendency to run businesses with higher short-term liabilities due within a year than the value of easily realisable assets, such as cash, trade receivables and inventory. This phenomenon is known as negative working capital.

This measure has deteriorated among our manufacturing companies, where there are now 12,741 (17%) with combined working capital deficits of £21bn. In December 2023, these figures were 16% and also £21bn, respectively. The continued deterioration of this indicator is not a positive sign.

Insolvency and business failure issues

For the UK economy as a whole, corporate failures are running at all-time record highs, continually breaking the previous peak seen in 2009 during the global financial crisis. For manufacturing, there were 1,797 corporate insolvency filings in England & Wales in the twelve months to June 2024, representing 7% of total insolvencies. This is broadly similar to the same period to June 2023, when there were 1,881 manufacturing failures.

With higher interest rates stretching viability and stressing cash flows, the economy yo-yoing between low growth and no growth, and the sector’s financial profile worsening, the prospects for avoiding an increase in manufacturing failures in the remainder of 2024 and through 2025 are not good.

Current trading performance

After gaining momentum throughout the first half of 2024, the sector’s output performance has fallen back. Despite earlier expectations of a consistent growth trajectory for the remainder of the year, the latest indicators show that output growth has paused in Q3 2024.

While output didn’t grow significantly in the first two quarters, the combination of consecutive positive quarters mixed with consistent demand conditions in the market led sector analysts to be quietly confident about growth staying the course.

With little in the way of notable economic shocks occurring in the UK market over the past 8 months, this confidence in consistency had been shared by economists and the industry alike, as measured by high levels of business confidence. The extraordinary turbulence of the last few years seemed as though it might have stabilised.

Unfortunately, manufacturing output decreased by 1% between June and July 2024 following an increase of 1.1% between May and June. Seven of the 13 sub-sectors saw declines in output between June and July. Output for the three months to July 2024 was 0.3% lower than in the three months to April 2024. Output in the three months to July 2024 was also 0.8% lower than output in the same period the previous year.

The next few months’ output numbers will make interesting reading in these stop-start conditions and with manufacturers facing a broad range of ongoing challenges, including:

- Geopolitical tensions damaging supply chain efficiency

- The continuing impact of Brexit

- Economic policies of the UK’s major trading partners, in particular China, the USA and major European players such as France and Germany.

- Global trade policies, particularly the imposition of tariffs and the erection of trade barriers.

- Technological advancement & adoption, most especially AI

- Environment & sustainability (ESG) considerations

- Workforce issues with an ageing demographic and over 60,000 vacancies

Future prospects for UK manufacturing

Our review of the sector’s finances is far from positive reading, with almost all key ratios and indicators continuing to deteriorate and an overall health financial health and risk profile well below par. At the same time, economic conditions both in the UK and in key international markets such as the USA are uncertain.

Despite this, opportunities for growth through organic expansion and acquisitions are there to be seized by companies with solid finances and sound internal discipline, always assuming that they commit to stringent due diligence and avoid losing sight of the risks inherent in growth strategies. Other businesses will need to pursue a ‘steady as she goes’ policy unless and until meaningful and sustained economic growth takes hold in the UK.

If you would like to discuss any of the points in the report or believe you have been affected by any of these issues, you can speak to one of our Partners who can discuss options with you.

We have offices nationwide and by contacting us on 020 3326 6454, you will be able to get immediate assistance from our Partner-led team.