Creditor Fee Guide

Explanation of Opus Restructuring LLP and Opus Business Project’s charging and expense recovery policies.

Insolvency Creditor Guides & Guides to Fees

R3 Guides for Creditors on Insolvency Processes and Insolvency Practitioner Fees

R3 is an Association of Business Recovery Professionals. The Association protects and promotes the environment and strong restructuring and insolvency frameworks required to enable members to fulfil their role in the economy and in society.

The Association provides a number of guides on insolvency processes and Insolvency Practitioners fees for creditors which can be found by clicking on the buttons below:

Information relating to Opus Restructuring LLP’s (trading as Opus Restructuring & Insolvency) fees and expenses

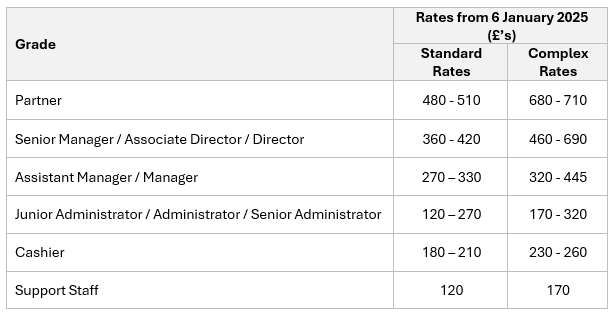

Time recording

Work undertaken on cases is recorded in 6-minute units in an electronic time recording system. Time properly incurred on cases is charged at the hourly rate of the grade of staff undertaking the work that applies at the time the work is done. The current hourly charge-out rates are:

For a complete list of Opus rates since January 2013, click here.

Expense recovery

In line with the revised Statement of Insolvency Practice 9 effective from 1 April 2021, creditors will note that in our previous circulars, expenses were known as disbursements. Should any creditor require any clarification on this point or the impact it will have on their claim, please contact us for further information.

Expenses are categorised as either Category 1 or Category 2.

Category 1 expenses

These will generally comprise of external parties which will include the supplies of incidental services specifically identifiable to the case. Where these have initially been paid by Opus Restructuring LLP and then recharged to the case, approval from creditors is required and are identified as Category 2 expenses. The amount recharged is the exact amount incurred.

Examples of Category 1 expenses include but are not limited to case advertising, invoiced travel, agents’ costs and expenses, solicitors’ fees and expenses, external room hire, bank charges, Insolv case management charge and properly reimbursed expenses incurred by personnel in connection with the case (including business mileage up to the HMRC approved rate for cases commenced before 1 November 2011). Also included will be services specific to the case where these cannot practically be provided internally such as printing, room hire and document storage.

Category 2 expenses

These include elements of shared or allocated costs incurred by Opus and are recharged to the estate; they are not attributed to the estate by a third-party invoice, and they do not include a profit element. These disbursements are recoverable in full, subject to the basis of the disbursement charge being approved by creditors in advance. Examples of Category 2 expenses are photocopying, all business mileage (for cases commencing on or after 1 November 2011). Payment of Category 2 expenses require the approval of creditors.

Included in Category 2 expenses are costs incurred with associated parties. These include Forensic work undertaken by Opus Pear Tree Limited.

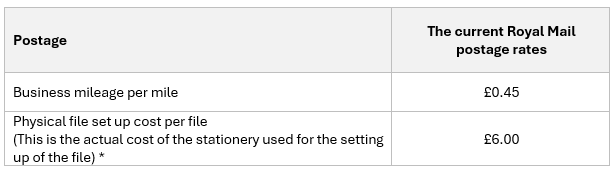

Examples of the current levels of Category 2 expenses recovered by Opus Restructuring LLP are as follows:

* The costs recharged are based upon the actual cost of the materials used or the costs which would have been incurred if that service had been sourced externally.

Information relating to Opus Business Projects Limited (trading as Opus Restructuring & Insolvency) fees and expenses

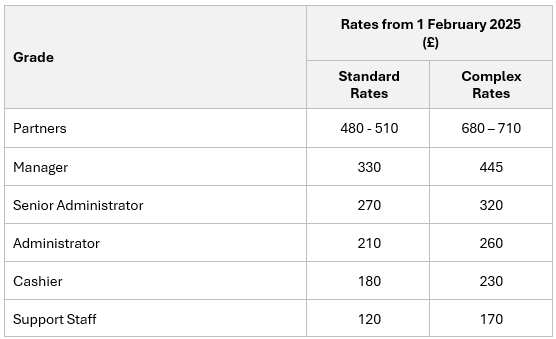

Current charge out rates

Time charging policy

Support staff do charge their time to each case.

Support staff include cashier, secretarial and administration support.

The minimum unit of time recorded is 6 minutes.

For a complete list of Opus Business Project rates, click here.

Keeping informed

Sign up to our monthly newsletter sharing the latest insights and industry news