Executive Summary

- 2024 has been a tough year, with a reduction in output, but 2025 is predicted to be better.

- The financial profile of the industry has stabilised by comparison with 2022 and earlier years but with clear vulnerabilities among smaller companies.

- The failure of the UK’s sixth largest contractor, ISG has rocked the whole sector, causing huge losses for its sub-contractors and suppliers, and damaging the appetite of funders to support construction businesses.

- Changes in government policy under the new Labour administration are predicated on a substantial increase in infrastructure projects and an even greater rise in housebuilding, challenging the industry’s capacity.

Market characteristics

Construction GDP was £132bn in the twelve months to June 2024, almost exactly the same outturn as the £131bn to the same period to June 2023. This represents some 6% of total UK GDP. This trend analysis was compiled by Trading Economics from Office for National Statistics (ONS) data.

The industry employed some 2.1m people in Q2 2024, equivalent to some 7% of the labour force. This compares with the pre-pandemic level of 2.3m in Q1 2020 and the peak over the past twenty-five years of 2.6m in Q3 2008, just as the global financial crisis started. The employment trend can be seen from statistics provided by Statista here.

The total assets employed in construction are now over £217bn, with a total net worth of £94bn. The sector borrows £29bn overall.

Current market conditions

Construction output has been erratic to date in 2024. Data from Trading Economics shows no clear pattern and in most months the outcome was better or worse than market expectations:

2024 (year-on-year figures)

August +0.3%

July -1.6%

June -1.7%

May +0.8%

April -3.3%

March -0.4%

February -2.0%

January +0.7%

Repair and Maintenance (R&M) continues to demonstrate greater resilience during a challenging year. Since 2021, R&M spend has consistently outperformed the new build construction market. This trend is expected to continue for the 2024 calendar year and beyond.

New build output across residential, commercial and industrial settings has been negatively impacted in 2024 and is predicted to be 4.3% lower compared to 2023 according to data published by PwC. The private housebuilding sector, in particular, has been challenged by high mortgage costs and building material and labour inflation. Additionally, investors continue to seek clarity on key objectives, such as unlocking planning constraints, incentivising increased output from volume housebuilders, creating conditions to enable SMEs to thrive and developing viable labour force, skills and productivity strategies.

The collapse of ISG

The appointment of Administrators to the UK’s sixth largest contractor on 20 September 2024 sent shock waves through the entire construction sector, although few industry insiders were surprised. Rumours of ISG’s financial vulnerability had been circulating for several years.

There were several reasons for ISG’s collapse, ranging from its more immediate inability to secure funding, failed attempts to secure a buyer, legacy financial difficulties from the pandemic and substantial involvement in loss-making contracts, leading to cash flow issues. Possibly the most significant factor, which is the subject of intense industry scrutiny, was ISG’s flawed business model, which was based on very narrow margins.

ISG’s operating margin appears to have been only c2%, with the majority of its work being subcontracted. In its 2022 annual report, ISG’s turnover was £2.18bn with a miniscule pre-tax profit of £11.5m. Such wafer thin margins and poor profitability are not unusual across the industry, but the sheer scale of losses on unprofitable contracts proved to be unsustainable for ISG.

The losses suffered by sub-contractors, suppliers and other creditors will be huge and come at a particularly difficult time as the sector goes into the more problematic winter period. There will undoubtedly be a spike in insolvencies as the effect ripples down the ISG supply chain and as the ISG collapse negatively effects the availability of funding across the industry.

We have analysed the ISG failure in greater detail here.

The 1.5m new homes building target

In addition to the broad announcement by the new government of a focus on infrastructure spending to boost growth in the sluggish UK economy, there is a specific target of building 300k new homes every year during this Parliament. We have examined the implications of the housebuilding target for housebuilders in our recent blog. What is certain is that efforts to meet the target will have a knock-on effect on capacity across the whole construction industry, particularly with its ongoing labour shortages.

Prospects for full years 2024 and 2025

Figures vary widely, but most pundits predict a fall in construction output in 2024 and a return to growth in 2025. Credit reporting experts Experian predict a 0.6% drop in 2024 and a 3.3% rise in 2025, while the Construction Products Association is looking for a 2.9% contraction in 2024 and a 2.0% recovery in 2025. These forecasts were published in July 2024, before the full details of the government’s programme for increased infrastructure spending and housebuilding were available. It remains unclear what impact this new policy focus will have on the industry’s output.

Financial risk profile

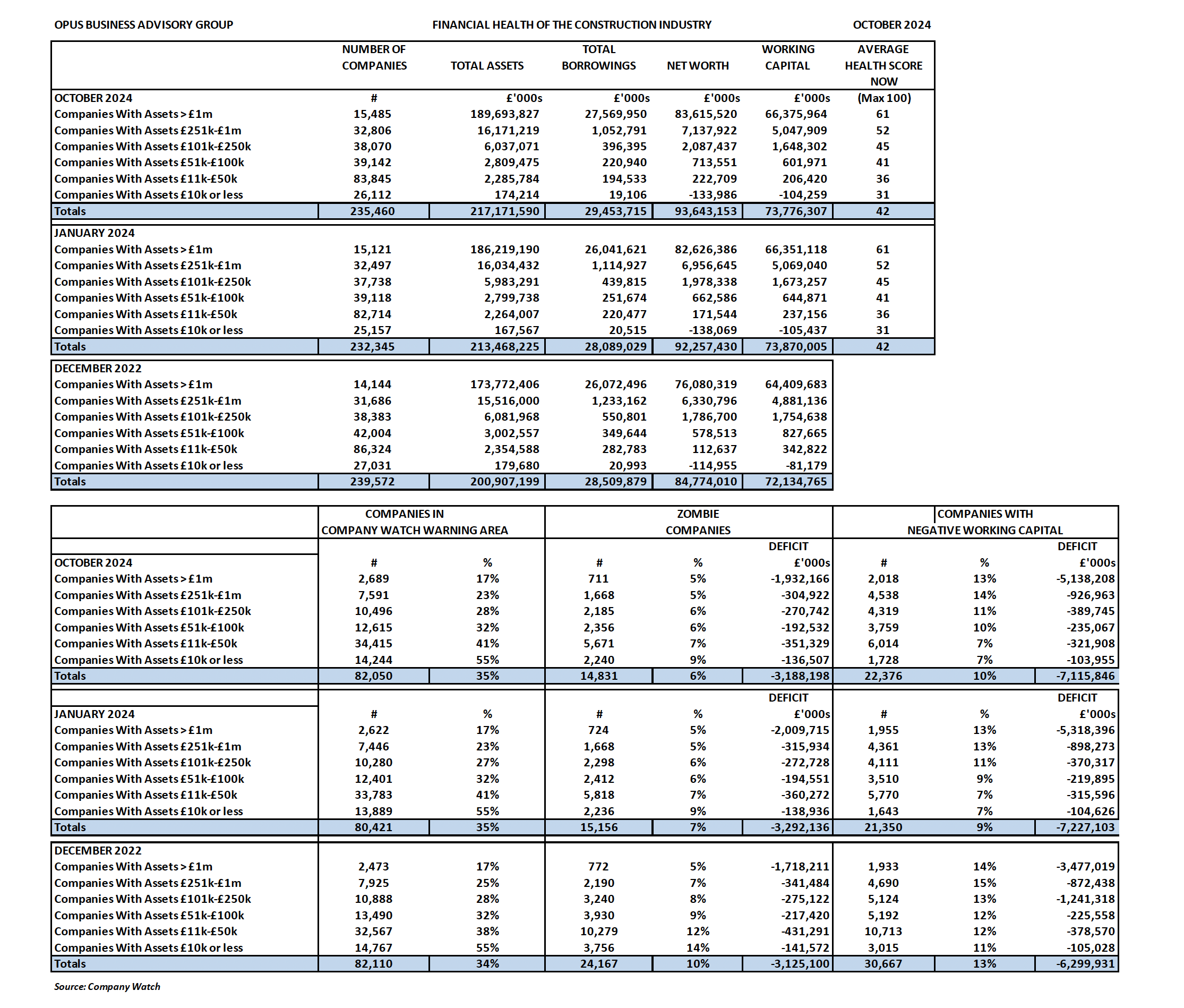

We have once again used the database maintained by the financial health monitoring company, Company Watch, to analyse the latest published accounts of each of the 235,460 companies registered at Companies House as operating in the sector. We were able to examine the most up-to-date financial data available and compare this with what we had found when we last looked at the construction industry in January 2024 and then before that in December 2022. Because of the delays in the filing deadlines at Companies House, the latest data mainly covers financial statements for trading periods ending in the second half of 2023 or early 2024.

A summary of our findings can be seen below.

The headline findings reveal little change in the financial profile of the sector in the past nine months, indicating that its financial health has at last stabilised after the damage inflicted by the pandemic, but it remains below par.

- The average Company Watch health rating (H-Score®) is unchanged at 42 out of a maximum of 100. Each sub-sector by company size is also unchanged.

- The number of companies in the Company Watch warning area is steady at 35%

- Total assets have risen since January 2024 from £213bn to £217bn now, in line with the increase in the number of companies during the period.

- Total borrowings have risen by £1.4bn since January 2024.

- Total net worth has improved marginally by £1.4bn.

- The number of ‘zombie’ companies with negative balance sheets has fallen from 7% of the total in January 2024 to 6% now.

- Conversely, the number of companies with negative working capital has gone up from 9% in January 2024 to 10% now.

We look at the key statistics headlined above in more detail below.

Company Watch warning area

Over a third of companies (82,050) of the companies were in the Company Watch warning area with an H-Score of 25 or less out of a maximum of a hundred. Statistics for the past twenty-five years confirm that at least one in four of these businesses will fail or need a major financial restructuring during the next three years.

Debt levels

Overall borrowings have risen from £28.1bn in January 2024 to £29.5bn in our latest research. Within this overall figure, debt has only increased at the largest construction companies with assets over £1m. In every other size category, contractors have been cutting debt. Gross gearing and net gearing levels are modest at 14% and 31%, respectively. These figures are very slightly up from 13% and 30% in January 2024 but are still not at significantly worrying levels.

‘Zombie’ companies

6% (14,831) companies are zombies, with negative balance sheets where liabilities exceed assets by at least a de minimis figure of £20,000. Their combined balance sheet deficits add up to £3.2bn. In January 2024, 7% of the companies were zombies, so this risk indicator has improved slightly, but the combined balance sheet shortfall is dropped by some £104m.

Negative Working Capital

We also looked at the working capital position of those construction businesses where ‘quick’ current assets such as receivables, cash, contract value and work in progress were lower than their short-term liabilities. We found that 10% (22,376) of the companies had negative working capital of at least our de minimis figure of £20k, with a combined deficit of £7.1bn. This measure has slightly worsened since January 2024, when there were only 9% in this category. This is not a healthy statistic for the industry, indicating significant potential for short-term financial pressure.

Size matters

As with our recent reviews of the finances of other industry sectors, there is a major discrepancy between larger businesses and smaller, less well-capitalised contractors. Accordingly, we broke down our analysis into six size ranges according to total assets per company. The varying outcomes for the various size categories are set out in the summary of our results above.

The contrast between the major players and small businesses is stark. The average H-Score for construction entities with assets of more than £1m is 61 out of a hundred, against the sector average of 42. But for the very smallest businesses, the average is almost halved at only 31.

The fragmentation and financial fragility of the sector is also apparent from the startling statistic that almost half of construction companies (109,957) have total assets of £50k or less and more than one in ten (26,112) have total assets of £10k or less.

Of the small companies with assets of £50k or less, a deeply worrying 44% (48,659) are in the Company Watch warning area.

Business failures

Achieving financial stability can be elusive for construction businesses. Year and year out, in good times and bad, between a fifth and a sixth of all UK insolvencies have been construction companies, in stark contrast to its far lower 6% share of GDP. In the twelve months to July 2024, there were 3,971 construction company insolvencies in the UK, 16% of the total business failures for the period.

This is welcome improvement from 19% in 2022, but unfortunately this reflects problems elsewhere in sectors like hospitality and retail, which were even more badly affected by the pandemic and subsequent labour shortages and cost inflation, rather than any reduction in the financial vulnerability of the construction sector.

Major issues for construction in 2024 and beyond

As with most sectors, construction faces a cocktail of challenges stretching through the remainder of this year and then in 2025. Some are familiar business model flaws, which have plagued the industry for decades. Others are newer and require innovative and radical thinking and action. None are easily or quickly solved. These issues include:

- Variable activity levels: if estimates are right, 2024 will have seen a lack of workload, before the recovery starts in 2025. Either way, there will need to be better discipline in only accepting profitable work at realistic margins and which can be funded from existing financial resources.

- Wafer-thin profit margins: with continuing input cost inflation and endemic excess competition, the sector may spend 2025 talking about improving margins but ending up chasing volume through suicide bidding. The ISG collapse is an object lesson for the whole sector.

- Supply chain abuse: what chance the little sub-contractor, exploited by a main contractor, or smaller contractors suffering at the whim of dominant clients. The ability to pass pain down the supply chain, along with endemic low margins, explains why construction continues to top the charts for insolvencies year after year.

- Labour and skills shortages: According to the RICS UK Construction Monitor for Q2 2024, labour shortages have eased from the high water mark a couple of years ago when around 80% of respondents reported a challenge in hiring. Nevertheless, the result in the latest survey is still just below 50%.

- Financial constraints: pending the monetary easing expected from the Bank of England between now and the end of this year, funding constraints continue to be the most widely cited factor limiting activity, with 61% of respondents to the RICS Monitor reporting that such issues have negatively impacted their business operations.

- High input costs: construction materials prices for all types of work fell by 1.1% in the 12 months to August 2024, the fifteenth consecutive monthly fall, according to the latest figures published by the Department for Business and Trade. This was a slightly larger decrease than the 1% fall seen in the year to July 2024. This confirms that input costs have softened but remain high in a market constantly demanding value for money from contractors.

- Digital transformation: like every other sector in the economy, construction is having to come to terms with a revolution driven by the breakneck development of AI technology and machine learning. This is affecting every aspect of its operating models, workflow planning management and performance monitoring.

- Diversity & inclusion: only 16% of the construction workforce were women in Q2 2023, and there are no statistics for the numbers of people identifying as neurodiverse. This is the subject of increasing public scrutiny and potential criticism. Solutions will be both difficult and long-term but will become an increasing priority for the sector.

- Sustainability: there was a time when ESG issues were the preserve of academics and politicians. Now, climate and other environmental activism have put them higher up the priority lists of business leaders. This is despite some tentative pushback by investors in major corporates in other sectors and particularly in the US. Enlightened construction businesses are already working hard to make these considerations a core part of their objectives, to some extent driven by pressure from investors and clients. More should and will be forced to follow their example.

The way forward

2024 has been a tough year for those running construction businesses, although at least they have been doing so against a background of more stable finances than in 2022 and earlier years. Prospects for 2025 look better, but the pressure to facilitate the new government’s wish list of increased infrastructure spending and a sharp increase in housebuilding will test the industry’s funding constraints and labour shortages. The failure of ISG has cast a long shadow over all contractors, big or small.

If you would like to discuss any of the points in the report or believe you have been affected by any of these issues, you can speak to one of our Partners who can discuss options with you.

We have offices nationwide and by contacting us on 020 3326 6454, you will be able to get immediate assistance from our Partner-led team.