A subtle but significant shift is taking place in the world of corporate debt and enforcement in Scotland. With liquidity tightening, inflationary pressures lingering, and refinancing options constrained, creditors are becoming more assertive and formal enforcement tools like winding-up petitions are firmly back in play.

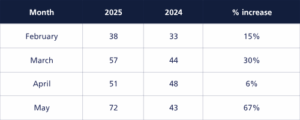

In the Scottish marketplace we have recently witnessed a sustained rise in creditor led compulsory liquidations:

Source: The Insolvency Service

Winding-up petitions have re-emerged

After several years of comparatively low interest rates, increased funding costs combined with trading and economic challenges has left many companies facing a harsher financial reality. Debt servicing and other costs overall have increased sharply, working capital has been eroded, and investor patience is wearing thin.

As a result, creditors are no longer content to wait. Payment terms are being enforced more rigidly, dispute tolerance is lower, and formal enforcement is being used earlier in the debt cycle — not as a last resort, but as a strategic lever.

Winding-up petitions, in particular, have re-emerged as a frontline pressure tactic. Petition volumes are rising, especially in sectors exposed to delayed payments, contract disputes, or margin compression — such as construction, hospitality, logistics, retail, and professional services.

How are winding-up petitions being used?

Though designed as a creditor enforcement route into insolvency, the winding-up petition has always had a dual purpose. It is now commonly used to:

- Force reluctant debtors to the negotiating table

- Create added pressure ahead of a disputed restructuring proposal

- Expose hidden liabilities or unresolved claims

- Provide leverage for a creditor in distressed situations

The reputational and operational impact of a petition – including frozen bank accounts and public notice via The Gazette – means it carries weight well beyond its technical purpose. For many companies, the mere threat of a petition is sufficient to trigger emergency refinancing, a fire sale, or a restructuring conversation. In 2025’s environment of limited funding headroom and higher debt-servicing burdens, these dynamics are accelerating.

Creditors are becoming increasingly assertive

We are seeing a more structured and deliberate approach to enforcement, particularly from institutional lenders, landlords, and larger trade creditors. This growing creditor assertiveness includes:

- Earlier legal instruction and more forensic pre-action analysis

- Coalition-building among unsecured or subordinated creditors

- Challenges to restructuring proposals, including CVAs and Restructuring Plans

- Support for investigations into directors’ conduct, related-party transactions, or antecedent payments

Litigation funders and insolvency practitioners are increasingly supporting recovery strategies that were once seen as too slow or only marginal effective.

Implications for companies and advisors

This rise in assertive creditor behaviour places renewed emphasis on early risk management and stakeholder communication. Companies who delay engagement, ignore payment issues, or fail to communicate intentions risk triggering sudden and disruptive legal escalation.

Company directors should focus on:

- Monitoring creditor sentiment and ageing payables’ profiles

- Engaging constructively with key suppliers and lenders

- Evaluating restructuring options before a petition becomes likely

Advisors, in turn, need to understand how legal enforcement is being used tactically. Today, restructuring is happening in the shadow of legal action, and companies must be prepared for more confrontational approaches.

A new phase in the credit cycle

As the UK enters a more strained and litigious phase of the credit cycle, the renewed use of winding-up petitions and more assertive creditor strategies reflect a broader market recalibration. The era of tolerance appears to be over. Patience has limits – and for many creditors, those limits have now been reached.

If you are seeking professional advice for your business on creditor enforcement risk issues, Opus is here to help. You can speak to one of the members from Opus, who can discuss options with you. We have offices nationwide and by contacting us on 0203 995 6380, you will be able to get immediate assistance from our Partner-led team.