Each month we publish a report into the financial fortunes of one of the major sectors in the UK economy, covering in turn retail, hospitality, construction, manufacturing and logistics amongst others. This gives us a view of the economic weather in each industry on a broadly bi-annual basis. Over the past two to three years most of these sectors have seen some level or other of deterioration in their financial risk profile, or else they present a picture of fragile stability but always at a below-par level.

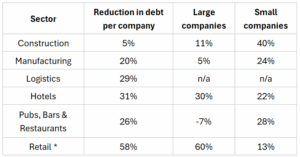

Amid the overall financial gloom, one significant positive feature time after time has been a reduction in external borrowings, both at a sector macro basis and in average third party debt per company. Importantly, in most instances the debt reduction by smaller companies has been greater than by their larger brethren.

The numbers for debt reduction

The bare statistics are startling, especially given that this phenomenon has taken place against a background of a severely sluggish economy and multiple economic shocks both in the UK and around the world.

* The overall and large company figures for retail are affected by the inclusion of significant banking operations in the balance sheets of certain major retail groups.

More information on the fall in borrowings of these sectors can be seen in our detailed schedule. The reductions shown above cover either a three or a two-year time frame.

The reasons behind lower borrowings

Economic context

The corporate funding landscape in the UK is witnessing a significant transformation as more companies opt to reduce their borrowings. This trend reflects a broader response to constantly changing economic conditions, higher interest rates and shifts in business strategy. External borrowing has traditionally been a vital element of corporate growth, enabling companies to invest in expansion, research, and innovation. Our research indicates a growing caution among UK businesses when it comes to leveraging debt for growth.

Coronavirus loan support schemes

The pandemic left an indelible mark on UK businesses, forcing many to reassess their financial strategies. Companies faced unprecedented disruptions, leading to increased borrowing to sustain operations.

Data from HM Treasury shows that 1.67 million UK companies borrowed a total of £79bn from the three main Coronavirus loan schemes between May 2020 and May 2021. These loans all came with repayment schedules, the fulfilment of which will be contributing to the drop in debt levels and will continue to do so for some years to come.

Higher interest rates

In recent few years, interest rates have been at elevated levels not seen in the working lives of many decision makers. Although rates have started to reduce, they remain high and many businesses will be locked into fixed rate facilities taken on in previous years. During most of the period covered by our research, the cost of servicing debt has been prohibitive at a time of economic uncertainty and squeezed profit margins, compelling companies to reconsider their reliance on external funding.

Balance sheet management

For many firms, reducing borrowings is a strategic step in strengthening their balance sheets, improving liquidity and enhancing their financial reputation. Businesses are keen to reduce dependencies on third party financing and adopt a more self-sufficient model of growth. This shift is particularly pronounced in sectors that experienced significant volatility during the pandemic, such as retail, hospitality and travel, but less so for construction and manufacturing.

Shift toward organic growth and sustainability

Another contributing factor to the decline in borrowings is the growing emphasis on organic growth and sustainability. Companies are increasingly recognising the risks associated with over-leverage, including the potential to destabilise operations during downturns. By reducing borrowings, firms are attempting to foster greater stability and safer growth through internally-generated resources rather than external debt.

Additionally, the corporate emphasis on sustainability extends beyond environmental considerations to financial decision-making. Reducing debt aligns with long-term sustainability goals, allowing businesses to focus on responsible practices and minimise financial risk.

Corporate strategy trends

Changing corporate strategies are also driving the decline in borrowings. Many UK companies are adopting a more conservative approach to expansion, prioritising efficiency and trying to achieve greater productivity as opposed to headlong growth. This shift reflects a more nuanced understanding of market dynamics and the need to mitigate risks associated with the recent and ongoing volatile economic conditions.

The growth and productivity challenge

Although the move toward reducing borrowings is largely positive, it is not without challenges. It is difficult for many companies to sustain growth without external financing, particularly in capital-intensive industries such as manufacturing and technology. Additionally, reduced borrowing could limit the scope of innovation and investment to generate productivity gains, impacting the competitiveness of UK firms both here in the UK and in global markets. The UK is a long-time laggard on business investment.

Lower borrowings: Is this a long term trend?

The trend of reducing borrowings among UK companies appears to reflect a prudent response to an extended period of the most severely disrupted economic conditions since WW2. Rising interest rates, post-pandemic recovery efforts and a shift toward sustainable and organic growth are driving this transformation in corporate funding. While the strategy has its benefits, businesses must strike a delicate balance between increased business investment and maintaining financial stability.

As the UK economy continues to adapt to these changes, especially to global factors beyond its control, the reduction in borrowings may herald a new era of corporate resilience and strategic foresight. By prioritising financial health, UK companies are positioning themselves to navigate future challenges with stability and confidence. Nevertheless, it remains to be seen whether they can resist the temptation to borrow their way to growth.

If you are seeking professional advice for your business, Opus is here to help. You can speak to one of our Partners, who can discuss options with you. We have offices nationwide and by contacting us on 0203 995 6380, you will be able to get immediate assistance from our Partner-led team.