Figures for December 2023 published by The Insolvency Service have confirmed that 2023 was a record year for business failures.

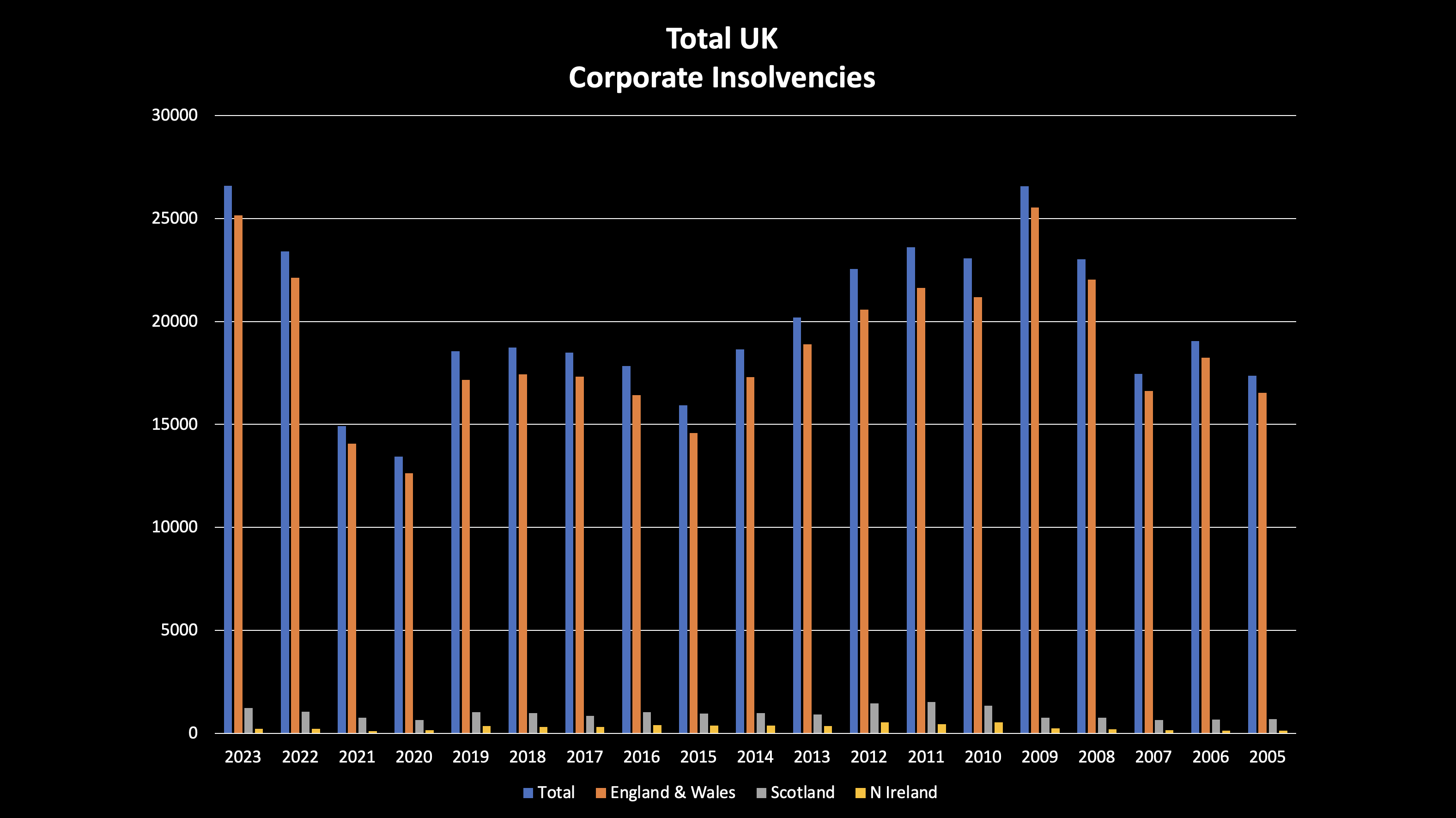

The annual total of 26,595 corporate insolvency filings is just a little higher than the previous record of 26,556 set in 2009 at the peak of the global financial crisis. This figure is 14% above 2022 and 43% up on pre-pandemic in 2019.

The 18 year trend in corporate insolvencies, broken down by region, can be seen from this graphic:

The surge in CVLs

By far the most striking feature of the insolvency statistics is the huge growth in Creditors’ Voluntary Liquidations (CVLs), where the Directors or Shareholders of a struggling company choose to cease trading and call in Liquidators, usually because their company is too badly damaged financially to survive and they can see no realistic prospect of any sort of rescue plan succeeding.

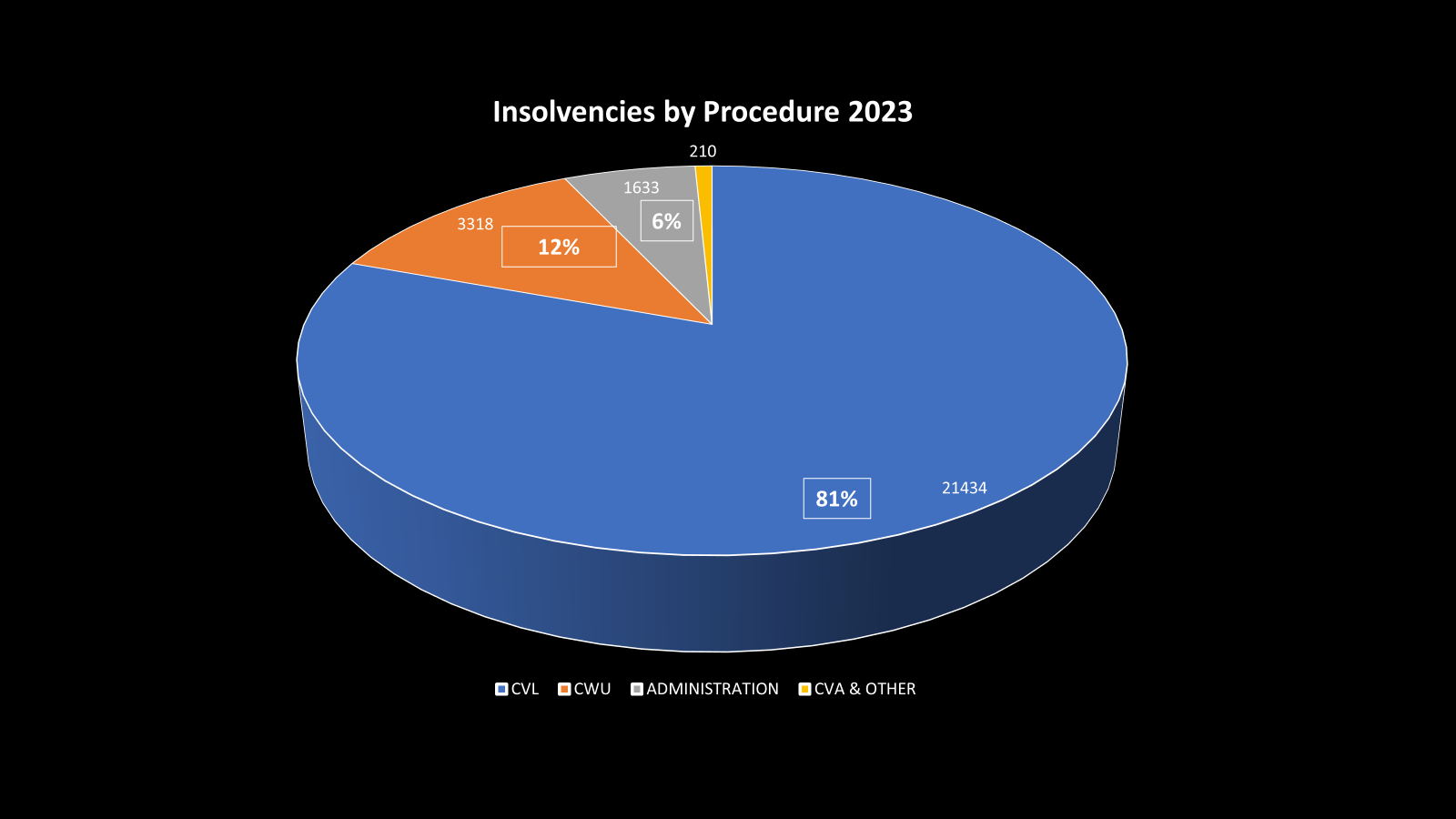

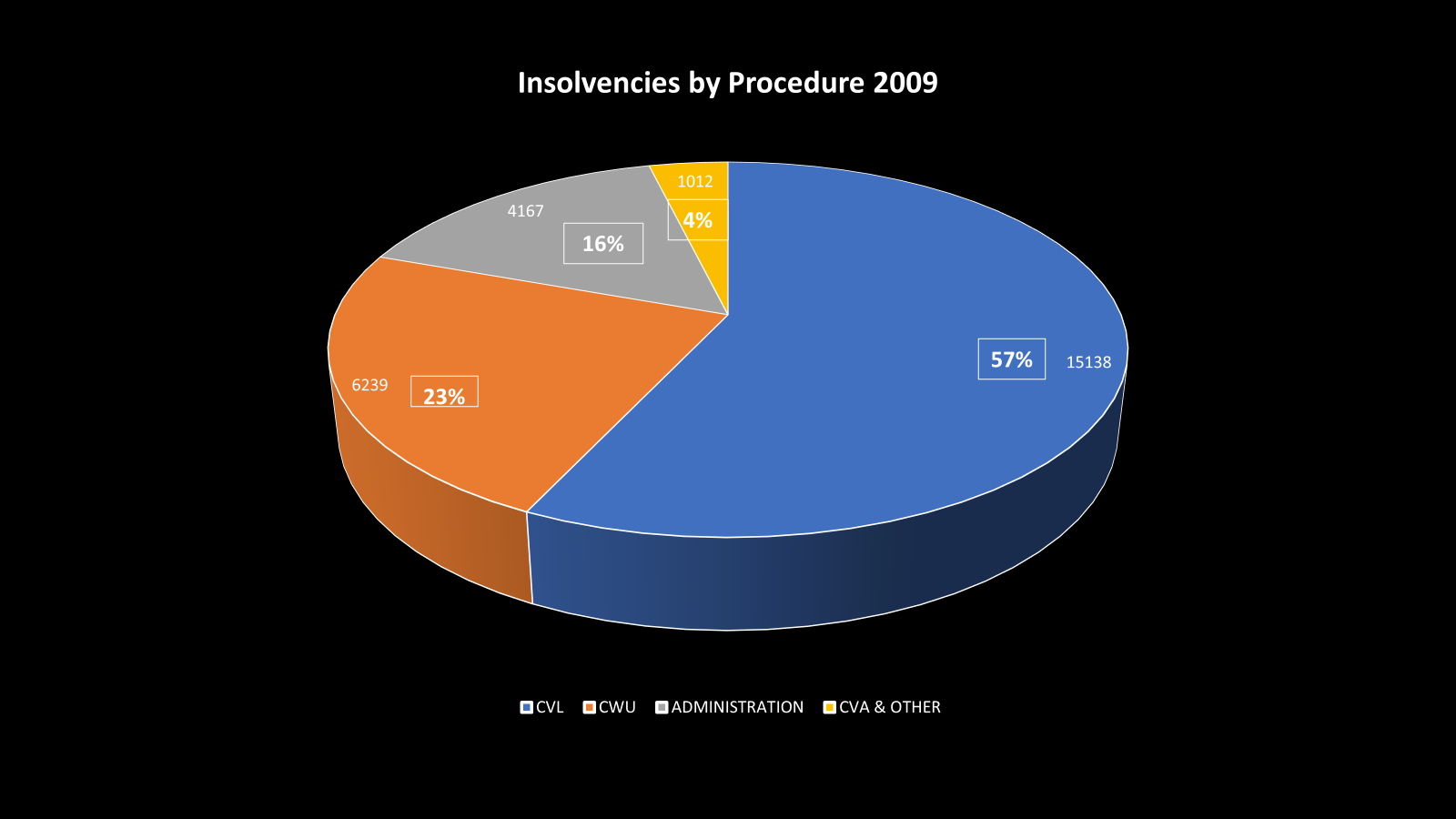

CVLs represented 81% of all business failures in 2023, compared to just 57% back in 2009. This clearly shows the impact of a succession of economic shocks that have hit the financial fabric businesses, and the morale of business owners, since the beginning of the pandemic in 2020.

The collapse in business rescues

The most frequently used route for non-consensual business rescues has traditionally been by using the Administration procedure. The 2023 figures from the Insolvency Service show a worrying decline, with Administration appointments falling from 4,167 (23%) in 2009 to only 1,633 (6%) in 2023.

The factors behind this include a reduction in the appetite for business rescues against a background of the UK economy’s low growth trend and prospects and the continuing uncertainty caused by geopolitical events. It may also reflect a smaller pool of funding for rescues, as well as the greater debilitation of company balance sheets and commercial viability after the past few years of unprecedented financial challenges.

The changes in the use of the various corporate procedures can be seen from these graphics:

Which sectors were worst hit?

The perennial winner of this unwanted prize is the construction industry, which accounted for 17% of all business insolvencies in 2023 although this was an improvement on having 19% of the casualties in 2022. Hospitality was second worst hit with 15% of failures, a deterioration from only 12% in 2022. Third was retail with 9%, up from 8% in 2022. These two sectors have borne the brunt of both the pandemic disruption and the cost of living crisis impact on consumers. In fourth and fifth place were manufacturing and professional services, both with 8% of 2023 insolvencies.

The challenges facing businesses

UK businesses have had to deal with a succession of major economic shocks, both domestic and global. The most significant problems go back to the start of the pandemic in 2020, but, even before then, chronic under-investment over decades had already weakened many firms’ productivity and competitiveness.

The pandemic was followed virtually straight away by the effects on supply chains and price increases caused by the Ukraine war. The final straw for many weakened businesses was the cost of living crisis and a rapid rise in interest rates.

Through these events, every aspect of a business’s finances has been impacted. As consumers reined in their spending, top line revenues were hit. Input cost inflation cut profit margins. Overheads soared, mainly because of escalating staffing costs, at the same time that a restricted labour market denied businesses the workforce they needed. Borrowings became more difficult to service as interest costs rose. The inevitable outcome for the more vulnerable, smaller businesses has been major cash flow challenges, reduced profitability, a battered balance sheet, resulting in little manoeuvrability and finally closure.

What will 2024 bring?

There are still many businesses that are hanging on amid increasing pressure from unpaid creditors. Economic prospects for the year look limited, with pundits predicting little or even no growth in GDP. Although there are hopes for interest rates cuts, the timing of these remains uncertain. The trade credit insurer, Atradius has forecast a further increase in business insolvencies of 5%, which would make this year’s total another record at 28,000.

Proactivity remains paramount for business owners

Every commentator is urging businesses with problems to be realistic about their future and to take advice from independent professionals at the earliest opportunity.

The longer action is delayed, the fewer positive options there are left on the table. This is always a tough decision for business owners and directors to take. But having specialist support through a restructuring and turnaround process or through the best insolvency route will give you the best chance for moving forward.

If you are seeking professional advice for your business, Opus is here to help. You can speak to one of our Partners who can discuss options with you. We have offices nationwide and by contacting us on 020 3326 6454, you will be able to get immediate assistance from our Partner-led team.