The Insolvency Service reported recently that 88 company insolvencies were recorded in Scotland in January 2024, which is 19% lower than the number in the previous January. This amounted to 34 compulsory liquidations, 46 creditor voluntary liquidations (CVLs), 7 administrations and one CVA.

January statistics on their own should not be regarded as a typical bellwether when trying to understand trends however, as the return to work following the Festive holidays tends to be staggered, and decisions predictably delayed until later in the month.

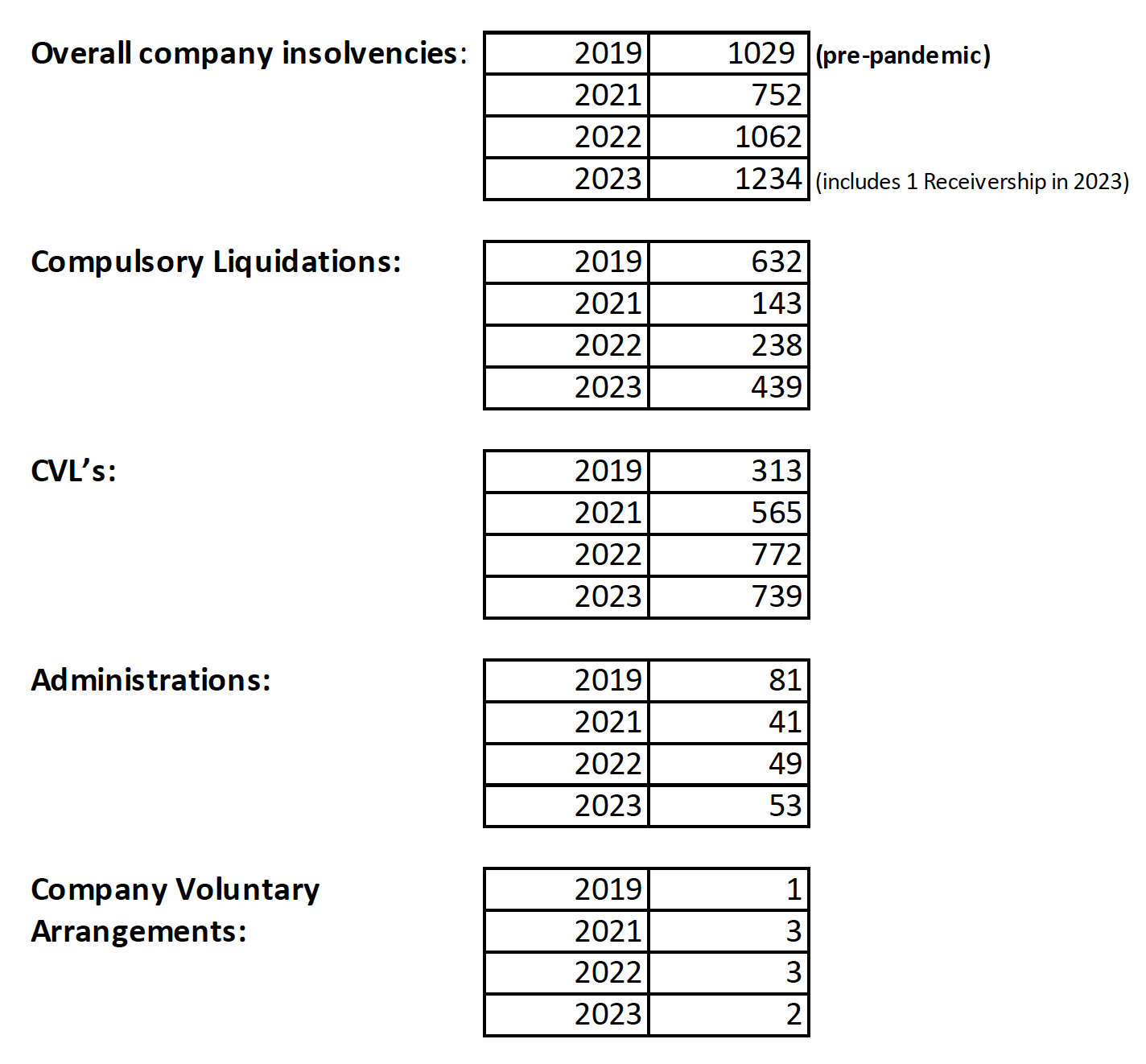

As can be seen below, there has been an increasing trend in company insolvencies over the last few years, particularly post Covid, where weary creditors have eventually started to get tougher on historical debtors and are prepared to wind up a business as the ultimate sanction. The growth in Scottish company insolvencies is widely expected to increase further throughout 2024, on the back of surging numbers of company failures in England and Wales, where they have seen corporate insolvencies reach a 30-year high. According to the Insolvency Service, the total number of company insolvencies for England and Wales only last year was 25,145, the highest number since 1993 and 14 per cent higher than in 2022.

A breakdown of Scottish insolvency stats

By contrast and comparison, courtesy of The Insolvency Service, the Scottish statistics reveal the following;

Where do the challenges for businesses lie?

The backdrop to these trends includes legislative changes and government responses to the COVID-19 pandemic, which have both supported and challenged businesses. The introduction of the Corporate Insolvency and Governance Act 2020, for example, created new restructuring and moratorium opportunities for businesses facing distress, yet the lifting of temporary measures which restricted the use of statutory demands and certain winding-up petitions has likely contributed to the increase in compulsory liquidations observed since the end of March 2022.

It can be seen that compulsory liquidations have yet to recover to pre-pandemic levels. Administrations are also significantly below the levels seen before Coronavirus struck. In stark contrast, voluntary liquidations (CVLs) have sky-rocketed and are now well over double their 2019 levels. This shows that Directors of businesses badly damaged during the crisis, and subsequently by the impact of the Ukraine war and then the cost of living crisis, have decided to take the difficult decision to wind down their business.

Reflecting broader economic challenges and the evolving landscape of corporate health, businesses in general across the UK emerged from the Covid era carrying increased debt levels. A complex mix of long-standing debt, rising interest rates, persistent inflation, and weakened customer demand has levelled considerable weight on businesses. The resultant cash flow pressure needs to be carefully managed on a day by day basis, and decisive steps taken by Directors to identify difficulties as they arise, and the appropriate remedial action taken. Early intervention can avoid the problems escalating to a point where the very existence of the business is threatened.

Looking to the year ahead

Looking at the economic prospects for 2024, the challenges faced by Scottish businesses are likely to persist, especially in sectors most vulnerable to high operational costs and low consumer spending. However, the recent statistics also reflect an economy which is adjusting to post-pandemic realities, including the winding down of government support measures and businesses adapting to a new economic environment. The resilience of the Scottish corporate sector will be tested, but opportunities for restructuring and innovation could emerge from these challenges. As businesses navigate this complex landscape, the role of insolvency practitioners and restructuring professionals will be critical in supporting both distressed businesses and those looking to capitalize on post-pandemic growth opportunities.

In conclusion, the Scottish insolvency market is facing a period of significant challenge and change, driven by a mix of economic pressures and evolving regulatory frameworks. While the increase in insolvency rates signals tough times ahead for some businesses, it also underscores the importance of adaptive strategies and the potential for recovery and growth in the longer term.

AUTHOR

This article was written by Insolvency Specialist, George Dale, Partner at Opus.

If you are seeking professional advice for your business, Opus is here to help. You can speak to one of our Partners who can discuss options with you. We have offices nationwide and by contacting us on 020 3326 6454, you will be able to get immediate assistance from our Partner-led team.