Economic Overview for December

As the festive season approaches, the business news continues to be dominated by reverberations from the Budget. There has been a stream of grim warnings about job cuts

As the festive season approaches, the business news continues to be dominated by reverberations from the Budget. There has been a stream of grim warnings about job cuts

Does the new government necessarily herald a new economic era? There has certainly been a change of tone, even if it seems rather more difficult to detect an actual change of mood as yet.

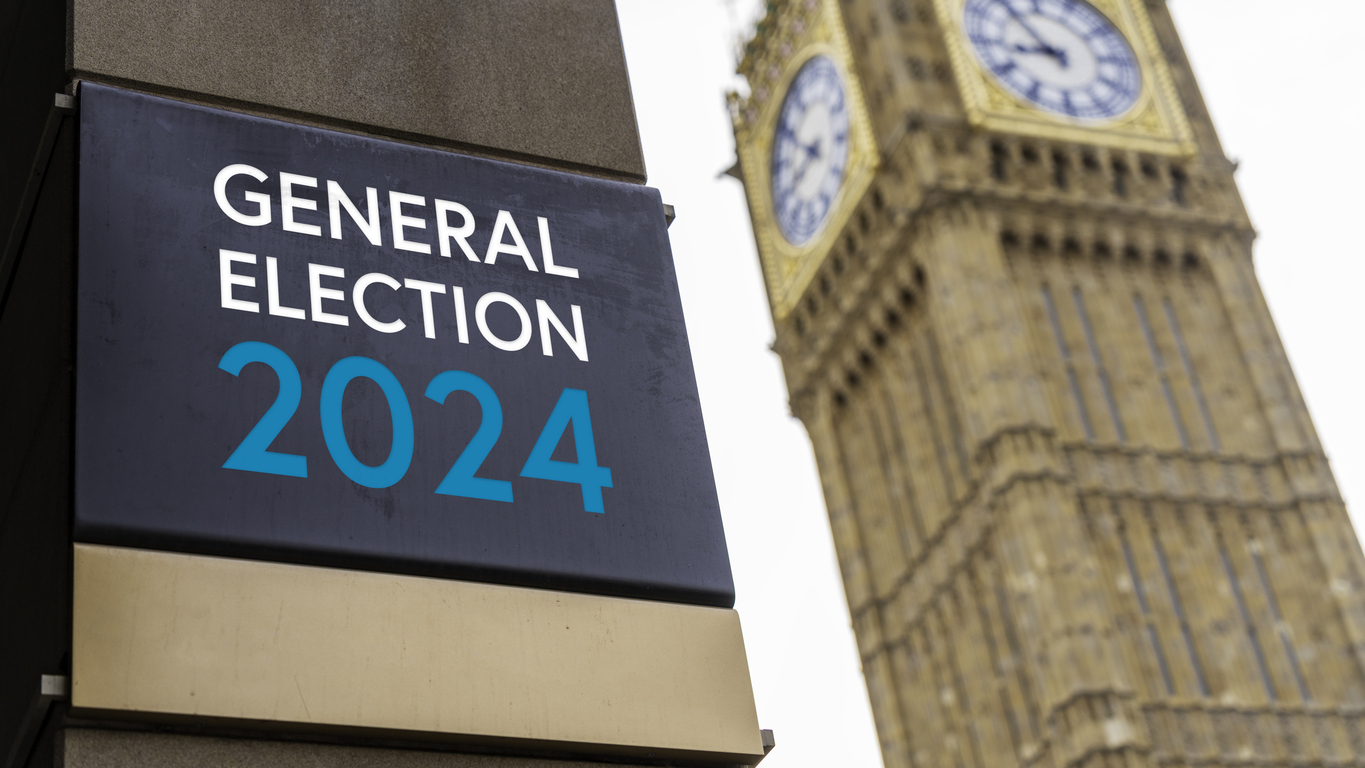

Thursday, July 4, 2024, was not just another Independence Day for the US; it marked the end of one political era and the beginning of what was promised

More mixed news on the economy amid the chaos of the election campaign As during any election campaign, it’s usually best to avoid all media interpretation of economic

Economic signals are still mixed but positive overall With the release of many more positive economic announcements in recent weeks, has the UK economy finally turned a corner

For the overwhelming majority of retailers, the festive season is make or break. Christmas and New Year 2024 may have delivered surprisingly buoyant top-line revenues, given the consumer