What happens to the funds raised by Insolvency Practitioners (IPs) after they are appointed as Administrators or Liquidators?

This is a mystery to almost everyone outside the insolvency profession and is so often the source of huge misunderstanding and upset amongst those stakeholders who find themselves at the end of the queue for distributions.

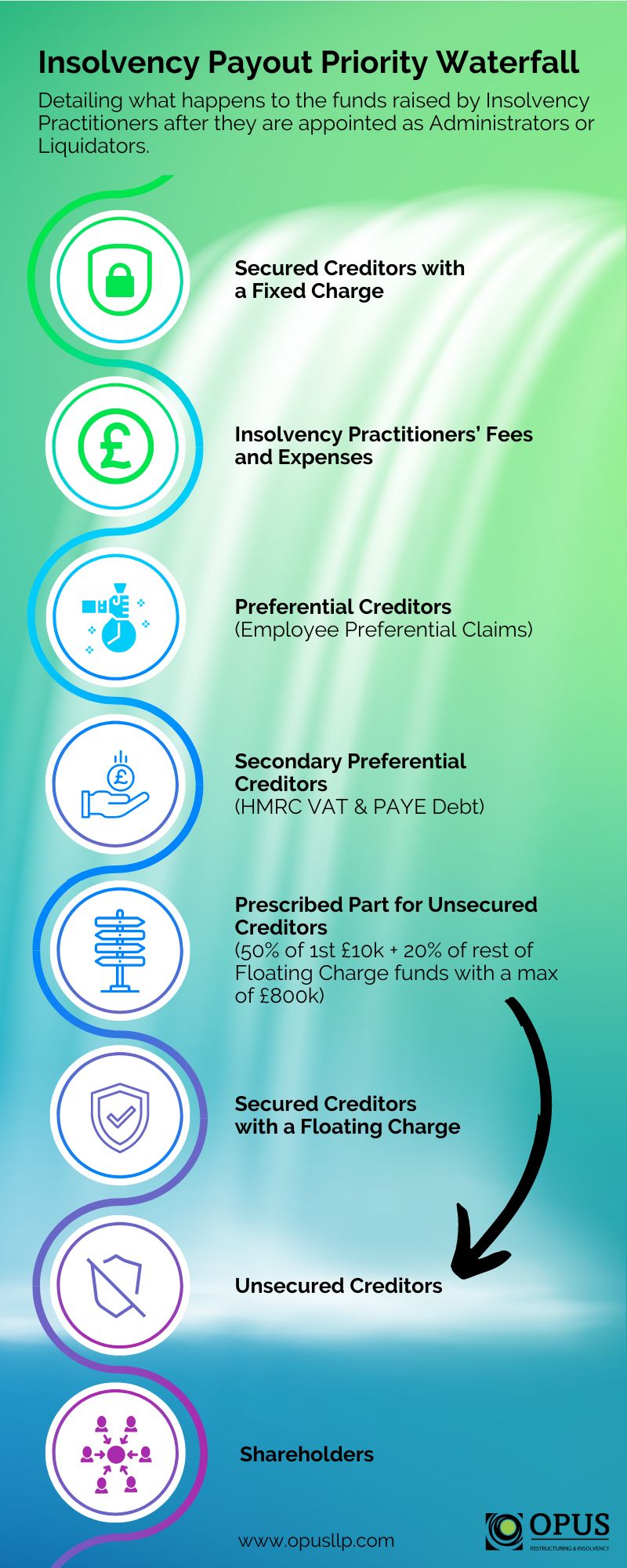

The best way is to look at how this plays out is think of the process in terms of a waterfall, with the money cascading down through a succession of recovery rock pools, where the lucky ones can scoop out enough to settle their debts before the remaining funds flow on down to the next pool.

The order of these pools can be seen in this diagram.

Who fits where in the pecking order, for which debts and why is described below.

Secured Creditors with a Fixed Charge

These are normally banks or other lenders, who protect themselves against a default by taking what is normally described as a Debenture over all the assets including a Fixed Charge or else a standalone Fixed Charge over individual assets, such as property, intellectual property, goodwill or in some instances, trade receivables. They get paid out first, but only out of the proceeds from selling these specific assets. The rationale for putting them first in the priority list is that this is what the borrower agreed and because if they weren’t given this priority, they would lend less or not lend at all. Ongoing interest charges on the debt to the lender continue to accrue and increase the debt until it is repaid.

The IPs fees and expenses

Stakeholders can often forget that the IPs appointed to resolve a company’s financial issues are volunteers, were not part of the management team on whose watch the company’s problems arose and are not charities. They are expert professionals, who are entitled to expect to be paid for the work they do, especially since much of it is mandatory compliance with various aspects of the insolvency legislation. Nevertheless, their costs are subject to scrutiny, control and approval and they routinely write off significant amounts of their costs for carrying out an insolvency.

Preferential creditors

In most insolvencies, the Preferential Creditors will be employee claims for arrears of pay up to a maximum of £800, plus outstanding holiday pay. Putting these claims at the top of the unsecured creditors is an obvious matter of public policy and fairness.

This should not be confused with the protection of employee claims through the Redundancy Payments Service, who will underwrite certain employee claims within certain limits if there are insufficient funds in the insolvency case to meet these claims. Details of which claims are protected can be found here.

There are certain other potential preferential claims, including protective awards made by an Employment Tribunal, claims under the Financial Services Compensation Scheme and claims for environmental damage.

You may also be interested in: Why does insolvency reduce business value?

Secondary Preferential Creditors and insolvency priority

As from 1 December 2020, HMRC were moved up the order of priority from unsecured creditors to secondary preferential status. Only certain specified HMRC debts are included:

- Value Added Tax (VAT)

- Pay As You Earn (PAYE) Income Tax

- Employee National Insurance contributions (NICs)

- Student loan repayments

- Construction Industry Scheme deductions

The Prescribed Part for Unsecured Creditors

Once again, public policy dictates that unsecured creditors should not lose out altogether in any insolvency where there are funds left over after Preferential and Secondary Preferential claims have been paid but not once Floating Charge (see below) claims have been satisfied. The mechanism is to carve out of the residual funds a nominal amount linked to asset realisations and limited to a maximum of £800k.

Secured creditors with a Floating Charge

When a lender takes security, it will look for extra protection against default from a ‘Floating Charge’ over those classes of assets where it cannot take a Fixed Charge, because they constantly change. A borrowers’ inventory is one example. If the lender’s debt is not fully repaid out of the proceeds of Fixed Charge assets, it can then recover further funds from the Floating Charge asset realisations.

Unsecured creditors

This category covers suppliers, service providers and landlords, or their trade insurers. They interact with the insolvent companies without any protection and at maximum risk. It may also include claims from those who hold a company’s bonds, depending on the exact nature of the contract between them and the insolvent company.

Shareholders and insolvency priority

Those who provide equity to a company are at the bottom of the pile when it comes to the distribution of funds in an insolvency. The rationale for this is explained in more detail in this article.

Get advice and get it early

If you are concerned about your repayment prospects in an insolvency, or need advice on how to protect your position ahead of or during the insolvency of a business where you are one of the stakeholders described in this blog, it is wise to take expert professional advice at the earliest opportunity.

If you are seeking professional advice for your business, Opus is here to help. You can speak to one of our Partners who can discuss options with you. We have offices nationwide and by contacting us on 020 3326 6454, you will be able to get immediate assistance from our Partner-led team.