Personal Insolvency Fee information

Personal Insolvency Fee information

England & Wales

Bankruptcy

Opus will act as Trustee in Bankruptcy if appointed by the Official Receiver or by the creditors. Our fees will be based on the Official Receiver’s scale of fees or such other amount as may be agreed by the creditors based on the time spent in dealing with the Bankrupt’s estate and/or asset realisations. The realisation and distribution scales for determining the remuneration of trustees and liquidators:

The realisation scale

- 20% of the first £5,000

- 15% of the next £5,000

- 10% of the next £9,000

- 5% on all further sums realised.

The distribution scale

- 10% on the first £5,000

- 5% on the next £5,000

- 5% on the next £90,000

- 5% on all further sums realised.

Individual Voluntary Arrangement (IVA)

When an individual proposes an IVA, certain fees are chargeable, being split into three distinct parts: a Nominee’s fee, which is charged by the Insolvency Practitioner who intends to act for the Debtor in preparing the Statement of Affairs and holding a meeting of the Debtor’s creditors; a Supervisors fee, the basis and quantum of which is approved by the creditors; and the expenses of the Arrangement, which are usually costs incurred by the Supervisor in carrying out their regulatory and statutory functions as office-holder.

The basis and quantum of the Nominee’s and Supervisor’s fees varies from case to case, depending on the relative complexity of the matters that need to be dealt with, or for instance the number of creditors involved.

The basis of a Nominee’s fees are invariably either on a fixed fee basis, or sometimes on a time-costs basis with an average fee charged in region of £5,000-£10,000 where a matter is straightforward and with a relatively low number of creditors, subject to negotiation once all the facts involved have been ascertained, and is set out in a letter of engagement. This is also based on Opus’ basic fee rate for time-costs. Where the matter is more complex a higher “complex rate” may be charged, for instance where overseas jurisdictions are involved, or there are complex claims or assets that the Nominee needs to deal with as part of preparing the Proposal.

The Nominees fees are drawn ahead of the first distribution to creditors from asset realisations.

The basis of the Supervisor’s fees may also be on a fixed fee basis, time-costs, or a percentage of the assets realised (or a mixture of these) and in the latter case this usually will be 15% of the assets pledged into the IVA fund and realised by the Supervisor, in line with industry standards and the statutory realisation fees charged by the Official Receiver in bankruptcy cases. So for example if £100,000 of assets were realised the average fee charged by the Supervisor will be up to £15,000, unless there are any especially complex matters to deal with, in which case the Supervisor will seek the approval of creditors for an increase in those fees.

Supervisor’s fees are usually paid in increments as the case progresses over the agreed period of the IVA. Most IVAs last for 5 or 6 years where they are based mostly on monthly contributions or a future potential re-mortgage of a family home, however they can last for lesser periods for instance where there are no monthly contributions pledged and the assets are to be realised on an accelerated basis, or where the creditors are offered a settlement from a third party contribution which they would not otherwise receive in a bankruptcy procedure.

Statutory expenses are incurred in every IVA – such as the registration fee with the Secretary of State (£15); searches of and registering restrictions over property at HM Land Registry (currently £3 for a search and £40 for a Restriction); the Supervisor’s Bond (insurance) over assets which varies from case to case but averages at around £100.

Note

It is vital that you maintain your contributions to the IVA, although under some circumstances your creditors may agree to vary the contribution amounts and frequency. If the IVA fails, you could be declared bankrupt.

Scotland

Sequestration

Fees charged by private sector insolvency practitioners for acting as Trustee following the Sequestration (Bankruptcy) of a debtor are subject to approval by the Accountant in Bankruptcy and are based on the time spent by the Trustee in administering the estate and may also be linked to asset realisations.

Protected Trust Deeds and Debt Payment Plans (through the Debt Arrangement Scheme)

As with all Trust Deed (PTD) and Debt Arrangement Scheme (DAS) providers, there are fees associated with these products, these are all included in your monthly payments. It is important these are fully explained before entering into a debt solution. You will always find us open about these fees and how they are charged.

Protected Trust Deeds (PTD)

All fees charged and expenses payable by your Trustee during a PTD are included in your monthly payment (the income contributions made by you and/or from the sums realised for your assets, if applicable). The fees and expenses of your PTD will be explained in detail in your Trust Deed paperwork. You do not have to pay additional fees other than those you agree to and if you do not proceed with a solution after seeking advice then there is no charge for our services.

- The Trustee’s fixed fee for a 4-year Trust Deed ranges from £1,000 to £2,500, this will vary depending on the work involved in your PTD and your creditors’ acceptance criteria.

- The Trustee’s realisation fee is charged based on a % of the funds received into your PTD, this typically ranges from 10-20% of the value of the funds.

Your creditors will be advised of the Trustee’s fees and expenses in your Protected Trust Deed proposal. Should you feel it necessary, you and/or your creditors can request the Accountant in Bankruptcy (AiB), the Scottish Government Agency that supervises Protected Trust Deeds, to carry out an audit of the Trustee’s fee. The AiB charge a 5% fee for this audit, this reduces the funds that will be distributed between your creditors.

The fixed and realisation fees are based upon the amount of work undertaken to set up your PTD and administer it during the 4-year term (can be longer, if required). Your Trustee along with suitably qualified members of his staff will undertake these tasks (this list is not exhaustive):

- Advice process

- Preparing your Protected Trust Deed proposal

- Obtaining protected status for your Trust Deed

- Dealing with your creditors, the AiB and any relevant third parties on your behalf

- Monitor payment of your income contributions

- Realising any assets for the benefit of your creditors

- Adjudicating on creditors’ claims

- Paying dividend/s to your creditors

- Dealing with any changes in your personal or financial circumstances during the PTD that could affect your payments and if necessary, liaising with your creditors regarding these changes

- Carrying out an annual review of your income and expenditure

- Reporting annually to your creditors, updating them on the progress of your PTD

- Finalising the administration of your PTD, processing yours and the Trustee’s discharge

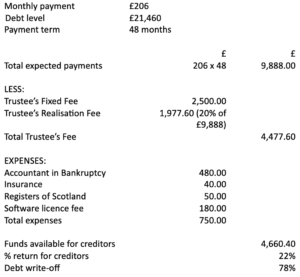

Based on an average PTD; the following is an example of the fees and expenses payable, the dividend payment to creditors and the possible debt write-off achievable in an average PTD:

Note

If at any point during a PTD, you feel like you may struggle to pay your income contribution, you must contact us immediately. It may be possible to arrange a change in payment amount or a payment break due to extenuating circumstances, assuming these could be evidenced. If you breach your payment agreement without making contact with us, you could be refused your discharge from the PTD which would leave you in the same position as you were before signing the Trust Deed i.e. having to repay all remaining debts in full (plus interest and minus any repayments made via the Trust Deed to date) and dealing with all creditors. In some cases, you may be sequestrated, (made bankrupt), for failing to comply with the terms of the Trust Deed. It is also possible for the Trustee to go directly to your employer and have the income contribution deducted from your salary, this will only happen if two consecutive payments have been missed and you are not co-operating with the Trustee.

Debt Arrangement Scheme (DAS)

There are no setup fees payable by an individual entering into a Debt Payment Plan (DPP) through the DAS. This is the same for all individuals whether they use an insolvency practitioner, private sector firm or a public sector organisation (e.g. Citizens Advice Bureau or a local authority Money Adviser).

The costs of administering the scheme are borne by the creditors and are the same for all DAS providers i.e. from every £ received into the scheme, 22p is used to pay these costs; this 22p is split between the DAS Administrator (2p) and the Money Adviser (20p). There may also be a payment made to the Payment Distributor (PD) and, if so, this would result in the Money Adviser’s fee being reduced by the same amount as paid to the PD (normally around 5p in the £). The remaining amounts are distributed amongst all creditors on a pro rata basis and a successfully completed DPP deems all debts to be repaid in full.

The fees and expenses of your DPP will be explained in detail in your DAS paperwork. You do not have to pay additional fees other than those you agree to and if you do not proceed with a solution after seeking advice then there is no charge for our services.

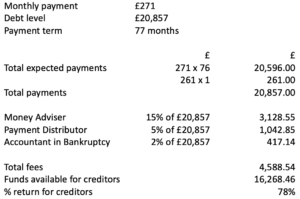

Based on an average DAS; the following is an example of the fees payable and payments to creditors:

(deemed to be payment in full, therefore, no debt write-off)

Note

It is essential that you maintain your agreed monthly contributions into your DPP. If at any point during the term of your DPP you feel you can no longer afford the payments agreed, you must contact your Money Adviser or their staff to discuss. Contacting us to discuss any payment difficulties you are experiencing or changes in circumstances is essential, DPPs under DAS do provide an element of flexibility. You may be entitled to a payment break in certain circumstances (such as illness or redundancy) or your Money Adviser may be able to review and amend your payment to suit your changed circumstances – this is subject to creditor approval. If you fail to keep up with your agreed payments and fail to contact your Money Adviser to discuss, your DPP may be revoked, leaving you liable for payment of your debts at their original contractual payment level (including interest and less any payments made to date).